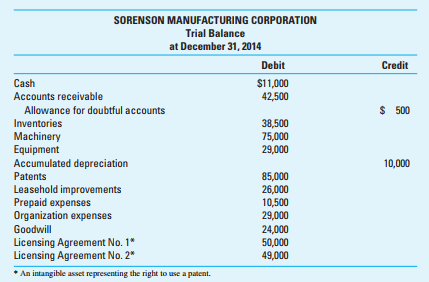

Question: Intangibles. Sorenson Manufacturing Corporation was incorporated on January 3, 2013. The corporation's financial statements for its first year's operations were not examined by a CPA. You have been engaged to audit the financial statements for the year ended December 31, 2014, and your work is substantially completed. A partial trial balance of the company's accounts follows:

The following information relates to accounts that may yet require adjustment:

1. Patents for Sorenson's manufacturing process were purchased January 2, 2014, at a cost of $68,000. An additional $17,000 was spent in December 2012 to improve machinery covered by the patents and charged to the Patents account. The patents had a remaining legal term of 17 years.

2. On January 3, 2011, Sorenson purchased two licensing agreements; at that time they were believed to have unlimited useful lives. The balance in the Licensing Agreement No.

1 account included its purchase price of $48,000 and $2,000 in acquisition expenses. Licensing Agreement No.

2 also was purchased on January 3, 2013, for $50,000, but it has been reduced by a credit of $1,000 for the advance collection of revenue from the agreement.

3. In December 2013, an explosion caused a permanent 60 percent reduction in the expected revenue-producing value of Licensing Agreement No. 1 and, in January 2014, a flood caused additional damage, which rendered the agreement worthless.

4. A study of Licensing Agreement No. 2 made by Sorenson in January 2014 revealed that its estimated remaining life expectancy was only 10 years as of January 1, 2014.

5. The balance in the Goodwill account includes $24,000 paid December 30, 2013, for an advertising program, which it is estimated will assist in increasing Sorenson's sales over a period of four years following the disbursement.