Question: Inflation: What You Foresee Is What You Get

What are inflation expectations, anyway? You won't find the term in any of the major economic data releases put out by the government. Yet whether inflation expectations are rising or falling may turn out to be a critical factor in determining how far and how fast the Federal Reserve raises interest rates. That, at least, is the new line coming out of the Fed these days. Inflation expectations-a bit of a touchy-feely concept-represent the beliefs of consumers, investors, corporate execs, and economists about how fast prices will rise in the future. To new Fed Chairman Ben S. Bernanke, inflation expectations are a key indicator. If people believe inflation will stay low, the Fed can afford to relax a bit. But if the masses start anticipating faster inflation, the odds are greater that the Fed will need to hit them with higher rates even if actual price hikes remain moderate. How are beliefs about future inflation measured? One way is to ask economists what they think is

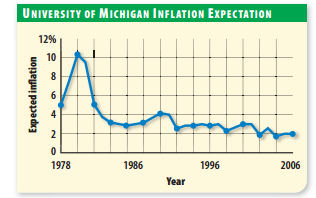

going to happen. According to the Philadelphia Fed's Survey of Professional Forecasters, economists expect consumer inflation to average 2.5% over the next 10 years, only a tad above their 2.45% forecast of a year earlier. That's not very worrisome. Another way to judge expectations is to look at the behavior of investors-in particular, the people who buy securities which are indexed to inflation to give investors a fixed real return. The danger, of course, is that expectations about future prices might jump, forcing the Fed to raise rates sharply to maintain its credibility as an inflation fighter. That's what happened in the 1970s, when the public's lack of faith in the Fed's inflation-fighting resolve sent prices-and expectations of future inflation-spiraling out of control after the oil shock. Contrast that with [the situation] today. The Fed has built credi bility by both aggressively fighting inflation and communicating its commitment to price stability. As a result, even as energy prices skyrocketed in recent years, inflation expectations hardly budged, and non-energy inflation stayed relatively low.

Examining the Newsclip Question

1. Defining How does the author of the article define inflation expectations?

2. Analyzing Why are inflation expectations important to the Fed?