Question: "Green" Suppliers

From Black Gold to Golden Corn?

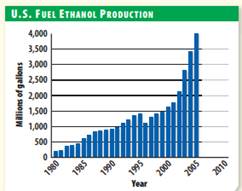

As the world supply of oil is spread among developing nations and becomes increasingly expensive, Americans are looking for alternative fuels. One option is ethanol, a renewable energy source made from corn and other plants. Ethanol suppliers and automakers are touting E85-a mixture of 15 percent gasoline and 85 percent ethanol-as a cleaner, domestic substitute for America's gas tanks.

Aventine and VeraSun: Aventine Renewable Energy, Inc., is just one ethanol supplier that is banking on the potential of plants. So far it's paying off. Aventine reported net income of $32 million on revenues of $935 million in 2005. That is an increase of 10 percent from 2004. Another ethanol supplier, VeraSun Energy Corp., has teamed up with General Motors and Ford to make E85 more available. Revenues for VeraSun look promising-from $194 million in 2004 to $111 million in just the first quarter of 2006.

Drawbacks vs. Benefits

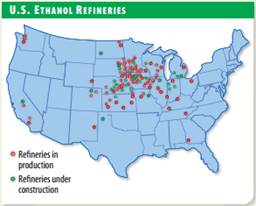

Ethanol does have some drawbacks. Only about 600 of the 180,000 U.S. service stations supply it. You also have to fill up more often, because ethanol contains less energy than gasoline. In addition, you have to drive a flexible-fuel vehicle (FFV) to use it. On the upside, ethanol yields about 26 percent more energy than it takes to produce it. Such a high yield is possible because sunlight is "free" and farming techniques have become highly efficient. As for the labor force, the ethanol industry supported the creation of more than 153,000 U.S. jobs in 2005. Perhaps the greatest benefit of increased ethanol supply will be reducing U.S. dependence on foreign oil.

Analyzing the Impact Question

1. Comparing and Contrasting What are the advantages and disadvantages of E85?

2. Drawing Conclusions What is the relationship between the increased cost of oil and the supply of ethanol?