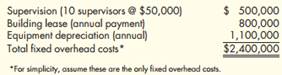

Question: Fixed Overhead Spending and Volume Variances, Capacity Management Lorale Company, a producer of recreational vehicles, recently decided to begin producing a major subassembly for jet skis. The subassembly would be used by Lorale's jet ski plants and also would be sold to other producers. The decision was made to lease two large buildings in two different locations: Little Rock, Arkansas, and Athens, Georgia. The company agreed to a 11-year, renewable lease contract. The plants were of the same size, and each had 10 production lines. New equipment was purchased for each line and workers were hired to operate the equipment. The company also hired production line supervisors for each plant. A supervisor is capable of directing up to two production lines per shift. Two shifts are run for each plant. The practical production capacity of each plant is 300,000 subassemblies per year. Two standard direct labor hours are allowed for each subassembly. The costs for leasing, equipment depreciation, and supervision for a single plant are as follows (the costs are assumed to be the same for each plant):

After beginning operations, Lorale discovered that demand for the product in the region covered by the Little Rock plant was less than anticipated. At the end of the first year, only 240,000 units were sold. The Athens plant sold 300,000 units as expected. The actual fixed overhead costs at the end of the first year were $2,500,000 (for each plant).

Required: 1. Calculate a fixed overhead rate based on standard direct labor hours.

2. Calculate the fixed overhead spending and volume variances for the Little Rock and Athens plants. What is the most likely cause of the spending variance? Why are the volume variances different for the two plants?

3. Suppose that from now on the sales for the Little Rock plant are expected to be no more than 240,000 units. What actions would you take to manage the capacity costs (fixed overhead costs)?

4. Calculate the fixed overhead cost per subassembly for each plant. Do they differ? Should they differ? Explain. Do ABC concepts help in analyzing this issue?