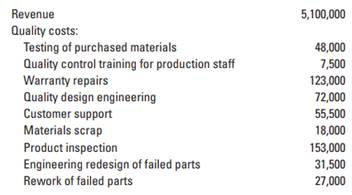

Question: Ethics and quality. Weston Corporation manufactures auto parts for two leading Japanese automakers. Nancy Evans is the management accountant for one of Weston's largest manufacturing plants. The plant's general manager, Chris Sheldon, has just returned from a meeting at corporate headquarters where quality expectations were outlined for 2017. Chris calls Nancy into his office to relay the corporate quality objective that total quality costs will not exceed 10% of total revenues by plant under any circumstances. Chris asks Nancy to provide him with a list of options for meeting corporate headquarters' quality objective. The plant's initial budgeted revenues and quality costs for 2017 are as follows:

Prior to receiving the new corporate quality objective, Nancy had collected information for all of the plant's possible options for improving both product quality and costs of quality. She was planning to introduce the idea of reengineering the manufacturing process at a one-time cost of $112,500, which would decrease product inspection costs by approximately 25% per year and was expected to reduce warranty repairs and customer support by an estimated 40% per year. After seeing the new corporate objective, Nancy is reconsidering the reengineering idea. Nancy crunches the numbers again. By increasing the cost-of-quality control training for production staff by $22,500 per year, the company would reduce inspection costs by 10% annually and reduce warranty repairs and customer support costs by 20% per year as well. She is leaning toward only presenting this latter option to Chris because this is the only option that meets the new corporate quality objective.

1. Calculate the ratio of each budgeted costs-of-quality category (prevention, appraisal, internal failure, and external failure) to budgeted revenues for 2017. Are the budgeted total costs of quality as a percentage of budgeted revenues currently less than 10%?

2. Which of the two quality options should Nancy propose to the general manager, Chris Sheldon? Show the 2-year outcome for each option:

(a) reengineer the manufacturing process for $112,500 and

(b) increase quality training expenditure by $22,500 per year.

3. Suppose Nancy decides not to present the reengineering option to Chris. Is Nancy's action unethical? Explain.