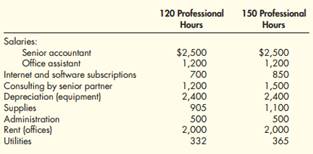

Question: Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firm's founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believes that an inexpensive accounting services clinic could provide basic accounting services for small businesses located in the barrio. He wants to price the services at cost. Since the clinic is brand new, it has no experience to go on. Carlos decided to operate the clinic for two months before determining how much to charge per hour on an ongoing basis. As a temporary measure, the clinic adopted an hourly charge of $25, half the amount charged by Fonseca, Ruiz, and Dunn for professional services. The accounting services clinic opened on January 1. During January, the clinic had 120 hours of professional service. During February, the activity was 150 hours. Costs for these two levels of activity usage are as follows:

Required: 1. Classify each cost as fixed, variable, or mixed, using hours of professional service as the activity driver.

2. Use the high-low method to separate the mixed costs into their fixed and variable components.

3. Luz Mondragon, the chief paraprofessional of the clinic, has estimated that the clinic will average 140 professional hours per month. If the clinic is to be operated as a nonprofit organization, how much will it need to charge per professional hour? How much of this charge is variable? How much is fixed?

4. Conceptual Connection: Suppose the accounting center averages 170 professional hours per month. How much would need to be charged per hour for the center to cover its costs? Explain why the per-hour charge decreased as the activity output increased.