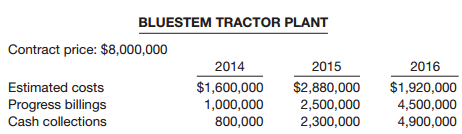

Question: (Completed-Contract and Percentage-of-Completion with Interim Loss) Reynolds Custom Builders (RCB) was established in 1987 by Avery Conway and initially built high-quality customized homes under contract with specific buyers. In 2002, Conway's two sons joined the company and expanded RCB's activities into the high-rise apartment and industrial plant markets. Upon the retirement of RCB's long-time financial manager, Conway's sons recently hired Ed Borke as controller for RCB. Borke, a former college friend of Conway's sons, has been associated with a public accounting firm for the last 6 years. Upon reviewing RCB's accounting practices, Borke observed that RCB followed the completedcontract method of revenue recognition, a carryover from the years when individual home building was the majority of RCB's operations. Several years ago, the predominant portion of RCB's activities shifted to the high-rise and industrial building areas. From land acquisition to the completion of construction, most building contracts cover several years. Under the circumstances, Borke believes that RCB should follow the percentage-of-completion method of accounting. From a typical building contract, Borke developed the following data.

(a) Explain the difference between completed-contract revenue recognition and percentage-of-completion revenue recognition.

(b) Using the data provided for the Bluestem Tractor Plant and assuming the percentage-of-completion method of revenue recognition is used, calculate RCB's revenue and gross profit for 2014, 2015, and 2016, under each of the following circumstances.

(1) Assume that all costs are incurred, all billings to customers are made, and all collections from customers are received within 30 days of billing, as planned.

(2) Further assume that, as a result of unforeseen local ordinances and the fact that the building site was in a wetlands area, RCB experienced cost overruns of $800,000 in 2014 to bring the site into compliance with the ordinances and to overcome wetlands barriers to construction.

(3) Further assume that, in addition to the cost overruns of $800,000 for this contract incurred under part (b)(2), inflationary factors over and above those anticipated in the development of the original contract cost have caused an additional cost overrun of $850,000 in 2015. It is not anticipated that any cost overruns will occur in 2016.