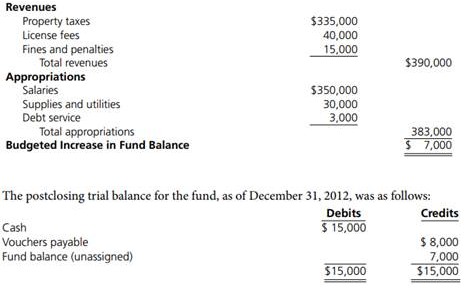

Question: (Complete accounting cycle and financial statements) The city council of E. Staatsboro approved the following budget for the General Fund for fiscal year 2013:

The following transactions and events occurred during FY 2013:

1. Levied property taxes of $335,000 and mailed tax bills to property owners.

2. Borrowed $300,000 on tax anticipation notes at an interest rate of 1 percent per annum.

3. Ordered supplies expected to cost $18,000.

4. Received the supplies along with an invoice for $19,000; paid the invoice immediately.

5. Received cash ($383,000) from the following

6. Paid cash for the following purposes: unpaid vouchers at the start of year ($8,000), salaries ($340,000), utility bills ($11,000).

7. Repaid the tax anticipation notes 6 months after the date of borrowing, with interest.

8. Processed a budgetary interchange, increasing the appropriation for supplies and utilities by $2,000 and reducing the appropriation for salaries by a like amount.

9. Will pay salaries for the last few days in December, amounting to $2,000, at the end of the first pay period in January 2014; also, received in early January 2014 a utilities invoice for $1,000 applicable to December 2013. Use the preceding information to do the following:

a. Prepare journal entries to record the budget and the listed transactions and events.

b. Prepare a preclosing trial balance.

c. Prepare a balance sheet; a statement of revenues, expenditures, and changes in fund balance; and a budgetary comparison schedule.

d. Prepare closing journal entries.