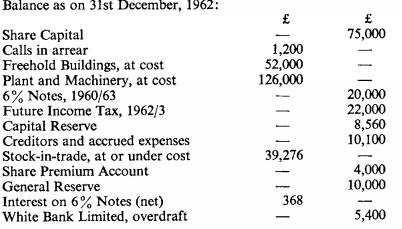

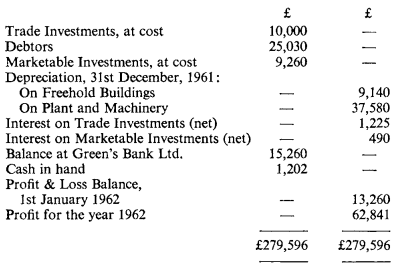

Question: Brisk Limited has an authorised share capital of £150,000 in shares of £1 each of which 100,000 shares have been issued on which 15/- per share has been called up.

After making some of the closing entries, the following is the Trial

Re-printed by courtesy of the Institute of Chartered Accountants (C.A.).

The profit for the year 1962 is after charging £3,000 salary of the factory manager, who is also a director, and writing off £1,800 to reduce the stock-in-trade to market value. Owing to a rise in raw material prices, the directors decide to set aside to set aside £4,000 as a replacement reserve. Provision is to be made for: depreciation on buildings at 5 % on cost and on plant and machinery at 8% on cost, directors' fees £1,000, auditors' remuneration, fixed by the directors, £630, doubtful debts £380, six months interest on the 6% notes (which were repaid on 1st January, 1963) and £5,000 for the cost of repairing damage caused by fire not covered by insurance. The liability for income tax 1962/3, Case 1, Schedule D, has been finally agreed at £18,526; on the profit of the year 1962, it is estimated to be £20,500. Profits tax for the year 1961 has been agreed and paid and an Overprovision of £474 has been included in the profit of the year 1962; for the year 1962, it is estimated to be £4,800. Marketable Investments have a market value of £8,540. There is no market quotation for the Trade Investments but they are considered to be at least worth their cost. The Directors decide to appropriate £5,000 to General Reserve and to recommend a dividend of 20%, less income tax, on the paid up share capital, the calls in arrear having since been received. You are required to prepare in a form suitable for publication the Balance Sheet of Brisk Ltd. as on 31st December, 1962, and the Profit & Loss Account for the year ended on that date. (Income Tax is 7/9 in the £).