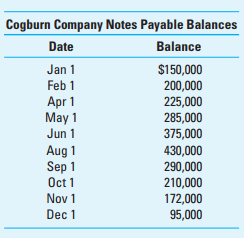

Question: Analytical Procedures and Interest Expense. Wey man Z. Wannamaker is the chief financial officer of Cogburn Company. He prides himself on being able to manage the company's cash resources to minimize the interest expense. Consequently, on the second business day of each month, Wey man pays down or draws cash on Cogburn's revolving line of credit at First National Bank in accordance with his cash requirements forecast. You are the auditor. You find the information on this line of credit in the following table. You inquired at First National Bank and learned that Cogburn Company's loan agreement specifies payment on the first day of each month for the interest due on the previous month's outstanding balance at the rate of "prime plus 1.5 percent." The bank gave you a report that showed the prime rate of interest was 8.5 percent for the first six months of the year and 8.0 percent for the last six months.

Required: a. Prepare an audit estimate of the amount of interest expense you expect to find as the balance of the interest expense account related to these notes payable.

b. Which of the types of analytical procedures did you use to determine this estimate?

c. Suppose that you find that the interest expense account shows expense of $23,650 related to these notes. What could account for this difference?

d. Suppose that you find that the interest expense account shows expense of $24,400 related to these notes. What could account for this difference?

e. Suppose that you find that the interest expense account shows expense of $25,200 related to these notes. What could account for this difference?