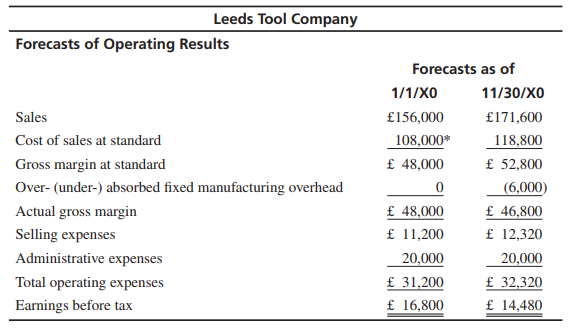

Question: Analysis of Operating Results Leeds Tool Company produces and sells a variety of machine-tooled products. The company employs a standard cost accounting system for record-keeping purposes. At the beginning of 20X0, the president of Leeds Tool presented the budget to the company's board of directors. The board accepted a target 20X0 profit of £16,800 and agreed to pay the president a bonus if profits exceeded the target. The president has been confident that the year's profit would exceed the budget target, since the monthly sales reports that he has been receiving have shown that sales for the year will exceed budget by 10%. The president is both disturbed and confused when the controller presents an adjusted forecast as of November 30, 20X0, indicating that profit will be 14% under budget:

There have been no sales price changes or product-mix shifts since the January 1, 20X0, forecast. The only cost variance on the income statement is the underapplied manufacturing overhead. This arose because the company produced only 16,000 standard machine hours (budgeted machine hours were 20,000) during 20X0, as a result of a shortage of raw materials while its principal supplier was closed by a strike. Fortunately, Leeds Tool's finished-goods inventory was large enough to fill all sales orders received.

1. Analyze and explain why the profit has declined despite increased sales and good control over costs. Show computations.

2. What plan, if any, could Leeds Tool adopt during December to improve its reported profit at year-end? Explain your answer.

3. Illustrate and explain how Leeds Tool could adopt an alternative internal cost-reporting procedure that would avoid the confusing effect of the present procedure. Show the revised forecasts under your alternative.

4. Would the alternative procedure described in number 3 be acceptable to the board of directors for financial-reporting purposes? Explain.