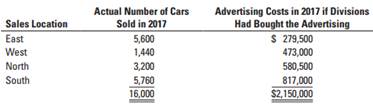

Question: Allocation of common costs. Jim Dandy Auto Sales uses all types of media to advertise its products (television, radio, newspaper, Internet, and so on). At the end of 2016, the company president, Jim McKinnley, decided that all advertising costs would be incurred by corporate headquarters and allocated to each of the company's four sales locations based on number of vehicles sold. Jim was confident that his corporate purchasing manager could negotiate better advertising contracts on a corporate-wide basis than each of the sales managers could on their own. McKinnley budgeted total advertising cost for 2017 to be $1.6 million. He introduced the new plan to his sales managers just before the New Year. The managers had already drawn up their advertising plans for 2017 and the corporate plan would do the same advertising for them as they had planned. Total advertising costs for 2017 were $1,600,000. If the managers had done this same advertising on their own, their advertising costs would be as follows:

The manager of the East sales location, Tom Stevens, was not happy. He complained that the new allocation method was unfair and increased his advertising costs significantly. The East location sold high volumes of low-priced used cars and most of the corporate advertising budget was related to new car sales.

1. Show the amount of the 2017 advertising cost ($1,600,000) that would be allocated to each of the divisions under the following criteria:

a. McKinnley's allocation method based on number of cars sold

b. The stand-alone method if divisions had done their own advertising

c. The incremental-allocation method, with divisions ranked on the basis of dollars they would have spent on advertising in 2017

2. Which method do you think is most equitable to the divisional sales managers? What other options might President Jim McKinnley have for allocating the advertising costs?