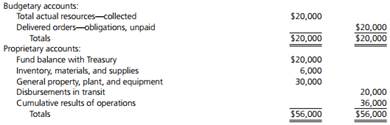

Question: (Accounting cycle and financial reporting) Following is a trial balance of the accounts of the Bureau of Bridge Inspection (BOBI), a relatively new unit of the Department of Transportation (DOT), as of October 1, 2013.

BOBI is responsible for overseeing state inspections of bridges constructed with federal funds. It reports program expenses by object of account. BOBI does not use commitment accounting, but does obligate budgetary resources when it enters into contracts or sends purchase orders to buy capital assets and supplies and materials. It also obligates resources for operating leases. The following transactions occurred during the month of October 2013:

1. Congress appropriated $2,000,000 for BOBI's bridge inspection program activities in fiscal year 2014.

2. OMB notified DOT that it had apportioned the entire amount of BOBI's appropriation.

3. DOT notified BOBI that it had allotted $500,000 of its appropriation for the first quarter of fiscal year 2014.

4. During the month of October, BOBI entered into the following contracts:

For testing equipment $ 100,000

For materials and supplies 50,000

BOBI also obligated the full amount of its operating lease payments ($90,000) for the first quarter of 2014.

5. Treasury advised BOBI that it paid the $20,000 invoice that BOBI had forwarded for payment before October 1, 2013.

6. BOBI received the materials and supplies ordered in transaction 4. However, the invoice was for $52,000 because the supplier sent additional supplies, as permitted by the contract. BOBI accepted the entire shipment. BOBI also recorded as a liability the $30,000 rent due October 1.

7. BOBI sent a disbursement schedule to Treasury requesting the following payments:

For materials and supplies $ 52,000

For rent 30,000

8. BOBI sent a disbursement schedule to Treasury requesting salary checks totaling $90,000.

9. Treasury advised BOBI that it had made payments totaling $172,000, pursuant to the schedules forwarded by BOBI in transactions 7 and 8.

10. To prepare accrual-basis financial statements for the month of October, BOBI made adjusting journal entries for the following items:

a. To accrue salaries earned in October but not paid-$10,000

b. To record materials and supplies used-$12,000

c. To record 1 month's depreciation on equipment-$1,000

Use the preceding information to do the following:

a. Prepare journal entries to record the foregoing transactions and events.

b. Prepare a preclosing trial balance based on transaction 1.

c. Prepare a balance sheet, a statement of net costs, and a statement of changes in net position.