Question: A and Β are in partnership, sharing profits in the proportions 60% and 40 % respectively and conduct a retail department store in London. The Goodwill of the business is valued at £20,000. On 1st January, 1962, C, who has a similar business in Bristol, joins them as a partner and aquires equally from A and Β a 20% share of their Goodwill; in payment for the Goodwill and as his contribution to the capital of the firm, C introduces the assets, less liabilities, of his Bristol business which were

Stock £1,200

Debtors £2,600

Lease of store £6,000

Fixtures £2,500

Creditors £2,300

The new firm decided that no account for Goodwill shall appear in the books; that C will continue to manage the Bristol store for which he will receive, out of the profits of that store, a partner's salary of £1,000 tRe-printed by courtesy of the Society of Incorporated Accountants (S.A.A.) per annum, and 5 % of the profits after charging the salary and percentage of profits; and that the balance of profits on the Bristol store shall be included with the London profits and the total divided among the partners as follows:

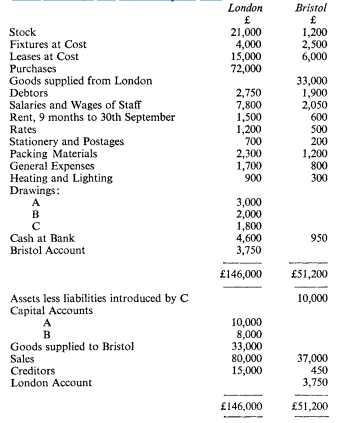

All purchases are made by the London store which delivers goods to Bristol at cost plus 20%. A Head Office charge of £500 per annum is to be made by London to Bristol but this has not yet been recorded in the books. The Trial Balance at 31st December, 1962 was

Fixtures are to be depreciated at 10% per annum and leases by 5% per annum. Three months rent is outstanding for both London and Bristol; rates include £200 (London) and £150 (Bristol) in respect of the three months ended 31st March, 1963.\

From the above information, prepare a Trading and Profit & Loss Account (in columnar form) for the year ended 31st December, 1962 and a Balance Sheet at that date. Submit the partners; Accounts (in columnar form)