Question 1:

Suppose that yi is a binary variable. Consider the regression equation

yi = β1 + β2x2i + β3x3i + ei

Assume that over the range of the data the linear specification is sufficiently close to the true population regression function for misspecification not to be an important issue.

Data for the variables are in this file.

Estimate the linear probability model using an appropriate method and test the null hypothesis that ,β2 = 0 and a two-sided alternative hypothesis.

(a) Enter the value of the test statistic in the box below (rounded to 2 decimal places). 0 using a t-test with a 5% significance level

(b) Enter the critical value in the box below (rounded to 3 decimal places)

(c) Do you reject the null hypothesis?

Question 2:

This file contains data on three variables, yi, x2i and x3i. yi, is a binary variable that takes values of 1 or 0 only.

Estimate a probit model in which y, is the dependent variable and x2i, and x3i, are explanatory variables.

(a) Enter the value of McFadden's pseudo-R2 in the box below (rounded to 3 decimal places).

(b) Use a likelihood ratio test with a 5% significance level to test the joint null hypothesis that x2i, and x3i, may both be omitted from the model. Enter the value of the test statistic in the box below (rounded to 3 decimal places).

(c) Based on the results of the above test. do you think that your model has explanatory power?

Question 3:

This file contains data on mortgage delinquencies. The variables are as follows:

• delinquent - 1 if payment late by 90+ days. 0 otherwise.

• arm = 1 if adjustable rate mortgage, 0 if fixed

• ref = 1 if for a refinance. 0 if for purchase

• insur = 1 if borrow has mortgage insurance, 0 otherwise.

• lvr = loan amount to value of property. percent

• rate = initial interest rate

• amount = loan amount in 5100.003 units

• credit = credit score

• term = loan term in years

(a) Estimate a logit model to predict delinquencies in terms of the other variables in the data set. Enter McFadden's R•squared in the box below.

(b) Use the logit model to predict the probability of delinquency for a 15 year $200,000 fixed rate purchase loan with a LVR of 90, and an initial interest rate of 5%. made to a customer with a credit score of 680 and mortgage insurance. Enter the probability in the box below

(c) Suppose that you run a mortgage book for a bank that wishes to maintain a delinquency rate of 5%. What is the maximum amount that you would be prepared to lend to a customer under the conditions listed in Part (b) (i.e. 15 year term, LVR of 90, etc). Enter the amount rounded to the nearest dollar in the box below.

Question 4:

Consider the regression equation

yi = β1 + β2x2i + β3x3i + ei

where x2i, is exogenous and zi, is endogenous. zi, is a valid instrument for x3.

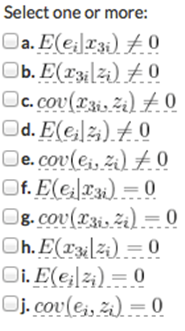

In this context, what is meant by the statement that x3, is endogenous?

You may select more than one condition. You will receive credit for each correct condition. You will lose marks for selecting an incorrect condition. The lowest mark that you can score for this question is zero.

Question 5:

Consider the regression equation

yi = β1 + β2x2i + β3x3i + β4x4i + β5x5i + ei

where x2i and x4i are endogenous and x3i and x5i are exogenous.

If there exist a single valid instruments zli. then the model is Select one:

a. overidentified

b. underidentified

c. exactly identified

Question 6:

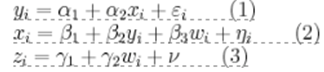

Consider the following system of simultaneous regression equations:

yi = β1 + β2x2i + β3x3i + β4x4i + β5x5i + ei

Assuming that all the parameters are non-zero, which of the following statements is true?

a. The OLS procedure is inconsistent for equations 1 and 2, but may be consistent for Equation 3. :_; b. The OLS procedure is inconsistent for equations 1, 2 and 3.

The OLS procedure is inconsistent for Equation 1, but may be consistent for equations 2 and 3.

d. The OLS procedure is inconsistent for equations 2 and 3, but may be consistent for Equation 1. ,e. The OLS procedure is inconsistent for equations 1 and 3, but may be consistent for Equation 2.

f. The OLS procedure is inconsistent for Equation 3, but may be consistent for equations land 2.

g. Equations 1,2 and 3 may all be consistently estimated using the OLS procedure.

h. The OLS procedure is inconsistent for Equation 2, but may be consistent for equations 1and 3.

Question 7:

Not yet saved Marked out of 1.00

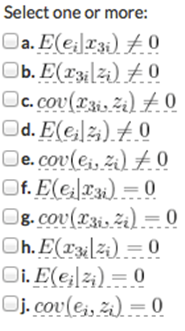

Consider the regression equation

where x2, is exogenous and x3, is endogenous.

Which of the following conditions must a variable satisfy to be useful as an instrument for x3,?

You may select more than one condition. You will receive credit for each correct condition. You will lose marks for selecting an incorrect condition. The lowest mark that you can score for this question is zero.

Question 8:

Consider the regression model yi = β1 + β2x2i + β3x3i + ei where 4:3,. is endogenous and 71:2, is exogenous. Two potential instruments, zi , and are available.

Open this data set in Gretl and estimate the model using the 2SLS approach and both instruments.

In order to get full marks for this question, you will need to estimate the first stage regression and the second stage regression separately using the OLS procedure.

(a) Enter the estimate of the intercept term of the first stage regression in the box below (rounded to 3 decimal places).

(b) Enter the 25LS estimate of t3L in the box below (rounded to 3 decimal places).

(c) Doyou think the instruments are weak or strong?

Question 9:

Consider the regression model yi = β1 + β2x2i + β3x3i + ei is known that X2i: is exogenous. It is suspected that :r may be endogenous. Data on another variable ; is available. It is known that zt; is correlated with X3i, and is uncorreleated with Using data from this file, test the null hypothesis that x3i is exogenous using a 1% significance level.

To get full marks for this question, you will need to construct a t-statistic from an auxiliary regression that you estimate by OLS, and be able to use Gretl to automatically generate a x2 statistic as part of an estimation routine.

(a) Enter the t-statistic that you calculated 'manually for the test in the box below (rounded to 3 decimal places).

(b) Enter the x2 statistic that Gretl generates for this test in the box below (rounded to 3 decimal places).

(c) Using the 'statistic, do you have evidence that X2, is endogenous?

Question 10:

Consider the regression model yi = β1 + β2x2i + β3x3i + ei where x2, is endogenous. Two potential instruments. zi and Z'2 t are available. Open this data set in Gretl and estimate the model using 2SLS with both instruments.

(a) Enter the sum of squared errors (SSE) of the 2SLS regression in the box below (rounded to 3 decimal places).

Conduct a Sargan test for instrument validity.

To get full marks for this question you will need to estimate the appropriate auxiliary regression equation and construct the test statistic 'manually'.

(b) In the box below, enter the estimate of the intercept term in the auxiliary regression (rounded to 3 decimal places).

(c) In the box below, enter the le of the auxiliary regression (rounded to 3 decimal places).

(d) Enter the value of the test statistic in the box below (rounded to 3 decimal places).

(e) Enter the critical value corresponding to a 1% significance level in the box below (rounded to 3 decimal places).

(f) Do you reject the null hypothesis?