Question 1

On the income statement, the amount of sales returns and allowances is normally:

A. Added into selling expenses.

B. Subtracted from gross margin to determine net sales.

C. Added in the calculation of cost of goods sold.

D. Subtracted from gross sales to determine net sales.

Question 2

Miranda Corp. received an order from a customer on October 1. The toys were shipped on October 15. The customer sent a check for full payment on November 5. Miranda received the check on November 10 and deposited it in the bank account. Miranda should record sales revenue related to this series of transactions on:

A. October 1

B. October 15

C. November 5

D. November 10

Question 3

When a credit sale is made with terms of 2/10, net 30 on May 10 and the customer's check is received on May 19, which of the following is true about the May 19 journal entry?

A. The debit to cash will equal the credit to accounts receivable because the discount was recorded on May 10.

B. There will be a debit to sales discounts on May 10.

C. The debit to cash will be less than the credit to accounts receivable on May 19.

D. There will be a credit to sales discounts on May 19.

Question 4

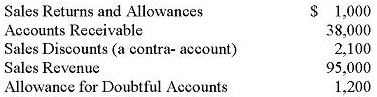

A company had the following partial list of account balances at year-end:(refer to attached image) The amount of Net Sales shown on the income statement would be:

A. $91,900

B. $90,700

C. $89,900

D. $88,600

Question 5

Dillon Company uses the allowance method to account for bad debts. The entry to write-off a bad account (one that will never be collected) should be:

Answer: Debit Credit

A. Bad debt expense Accounts receivable

B. Bad debt expense Allowance for doubtful accounts

C. Sales revenue Accounts receivable

D. Allowance for doubtful accounts Accounts receivable

A. Debit Credit

Bad debt expense Accounts receivable

B. Debit Credit

Bad debt expense Allowance for doubtful accounts

C. Debit Credit

Sales revenue Accounts receivable

D. Debit Credit

Allowance for doubtful accounts Accounts receivable

Question 6

Which generally accepted accounting principle best supports the establishment of the account, allowance for doubtful accounts?

A. Matching principle

B. Continuity principle

C. Exception principle

D. Revenue principle

Question 7

Oakwood Company had accounts receivable of $750,000 and an allowance for doubtful accounts of the $21,500 just prior to writing off as worthless an account receivable for Hyland Company of $5,000. The net realizable value of accounts receivable as shown by the accounting record before and after the write-off was as follows:

A. Before After

$750,000 $750,000

B. Before After

$721,500 $733,500

C. Before After

$728,500 $723,500

D. Before After

$728,500 $728,500

Question 8

At year end, Chief Company has a balance of $10,000 in accounts receivable of which $1,000 is more than 30 days overdue. Chief has a credit balance of $100 in the allowance for doubtful accounts before any year-end adjustments. Chief estimates its bad debts losses at 1% of current accounts and 10% of accounts over thirty days. What adjustment should Chief make to the allowance for doubtful accounts?

A. $200 (credit)

B. $100 (credit)

C. $90 (credit)

D. No adjustment as the current balance is correct

Question 9

Which of the following entries will affect both the balance sheet and the income statement?

A. Adjusting the allowance for doubtful accounts at year-end to the amount deemed uncollectible

B. Writing off an uncollectible account

C. Payment from a customer on account

D. None of the entries affects the balance sheet and income statement

Question 10

On December 31, 2009, Colonial Corporation had the following account balances related to credit sales and receivables prior to recording adjusting entries:

Accounts receivable $25,000

Allowance for doubtful accounts 200 (credit)

Sales revenue (all credit sales) 400,000

Required:

Present the necessary year-end adjusting entry related to uncollectible accounts for each of the following independent assumptions:

A. An aging of accounts receivable is completed. It is estimated that $2,150 of the receivables outstanding

at year-end will be uncollectible.

B. It is estimated that 1% of credit sales for the year will prove to be uncollectible.

C. Assume the same information presented in (1. above except that prior to adjustment, the Allowance for

Doubtful Accounts had a debit balance of $200 rather than a credit balance of $200.

11. Adjusting the Financial Statements

Adjusting entries made by companies each period often involve the use of estimates. Examples would include calculating depreciation of long-lived assets, determining the amount of accounts receivable that are uncollectible or estimating the impairment of assets that are no longer worth the amount paid for them.

-How does the use of estimates affect the financial statements of a company?

- In your opinion, does the use of estimates create opportunities for companies' to manipulate financial reporting?