Question 1 - Welfare effects of free trade in an exporting country

Consider the Bolivian market for lemons.

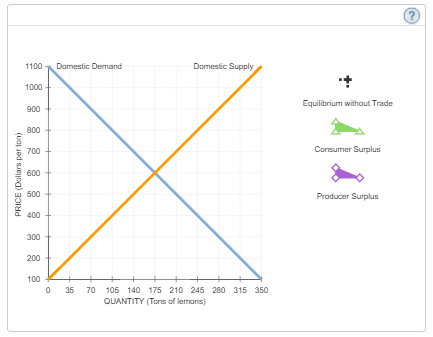

The following graph shows the domestic and domestic supply curves for lemons in Bolivia. Suppose Bolivia's government currently does not allow international trade in lemons.

Use the black point (plus symbol) to indicate the equilibrium price of a ton of lemons and the equilibrium quantity of lemons in Bolivia in the absence of international trade. Then, use the green triangle (triangle symbol) to shade the area representing consumer surplus in equilibrium. Finally, use the purple triangle (diamond symbol) to shade the area representing producer surplus in equilibrium.

Based on the previous graph, total surplus in the absence of international trade is $ _____.

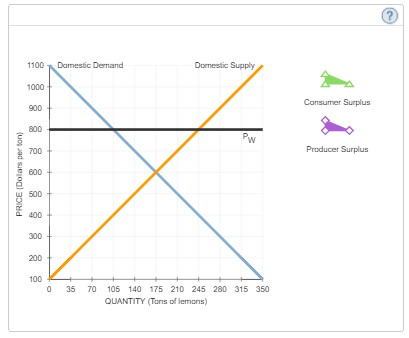

The following graph shows the same domestic demand and supply curves for lemons in Bolivia. Suppose that the Bolivian government changes its international trade policy to allow free trade in lemons. The horizontal black line (PW) represents the world price of lemons at $800 per ton. Assume that Bolivia's entry into the world market for lemons has no effect on the world price and there are no transportation or transaction costs associated with international trade in lemons. Also assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place.

Use the green triangle (triangle symbol) to shade consumer surplus, and then use the purple triangle (diamond symbol) to shade producer surplus.

When Bolivia allows free trade of lemons, the price of a ton of lemons in Bolivia will be $800. At this price, _____ tons of lemons will be demanded in Bolivia, and, _______ tons will be supplied by domestic suppliers. Therefore, Bolivia will export ______ tons of lemons.

Question 2 -

Consider the market for meekers in the imaginary economy of Meekertown. In the absence of international trade, the domestic price of meekers is $25. Suppose that the world price of meekers is $30. Assume that Meekertown is too small to influence the world price of meekers once it enters the international market.

If Meekertown allows free trade, then it will _______ meekers.

Given current economic conditions in Meeker complete the following table by indicating whether each of the statements is true or false.

Statement - True and False

Meekertownian consumers are better off under free trade than they were before.

Meekertownian producers are worse off under free trade than they were before.

True or False: When a country is too small to affect the world price, allowing free trade will never increase total surplus in that country, regardless of whether it imports or exports as a result of international trade.

Question 3 -

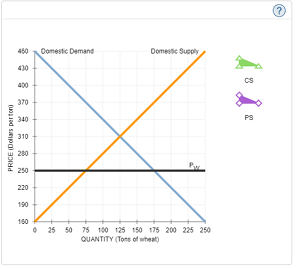

On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS).

If Bolivia allows international trade in the market for wheat, it will import ______ tons of wheat.

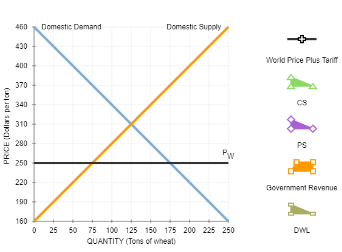

Now suppose the Bolivian government decides to impose a tariff of $30 on each imported ton of wheat After the tariff, the price Bolivian consumers pay for a ton of wheat is $ ______, and Bolivia will import _____ tons of wheat.

Show the effects of the $30 tariff on the following graph.

Use the black line (plus symbol) to indicate the world price plus the tariff. Then, use the green points (triangle symbols) to show the consumer surplus with the tariff and the purple triangle (diamond symbols) to show the producer surplus with the tariff. Lastly, use the orange quadrilateral (square symbols) to shade the area representing government revenue received from the tariff and the tan points (rectangle symbols) to shade the areas representing deadweight loss (OWL) caused by the tariff.

Complete the following table to summarize your results from the previous two graphs.

|

|

Under Free Trade (Dollars)

|

Under a Tariff (Dollars)

|

|

Consumers Surplus

|

|

|

|

Producer Surplus

|

|

|

|

Government Revenue

|

|

|

Based on your analysis, as a result of the tariff, Bolivia's consumer surplus ________ (Decrease or increase) by $________, producer surplus and the government collects $_______ in revenue. Therefore, the net welfare effect is a ______ of $________.

Question 4 -

The following graph shows the domestic supply of and demand for maize in Sudan. The world price (PW) of maize is $245 per ton and is represented by the horizontal black line. Throughout the question, assume that the amount demanded by any one country does not affect the world price of maize and that there are no transportation or transaction costs associated with international trade in maize. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place.

If Sudan is open to international trade in maize without any restrictions, it will import _______ tons of maize.

Suppose the Sudanese government wants to reduce imports to exactly 100 tons of maize to help domestic producers. A tariff of $______ per ton will achieve this.

A tariff set at this level would raise $______ in revenue for the Sudanese government.

Question 5 - Free-trade benefits

In addition to the positive welfare effects that free trade has on an economy, there are a variety of other benefits of international trade. Consider the following scenario:

Without free trade, Rooby has market power as a local producer. Once free trade is implemented in the local economy, Rooky is no Ionger able to raise its prices above competitive levels.

The previous scenario represents which of the following benefits of free trade?

- Increased variety of goods

- Lower costs through economies of scale

- An enhanced flow of ideas

- Increased competition

Question 6 -

Suppose there is a policy debate regarding the United States' imposing trade restriction on imported ball bearings.

Read the following scenario and answer the question that follows.

Domestic producers of ball bearings send a lobbyist to the U.S. government to request that the government impose trade restrictions on imports of ball bearings. The lobbyist claims that producers in other countries receive subsidies to export ball bearings and that domestic suppliers can't compete in the international marketplace.

Which of the following justifications is the lobbyist using to argue for the trade restriction on bail bearings?

- Infant-industry argument

- Unfair-competition argument

- National-security argument

- Using-protection-as-a-bargaining-chip argument

- Jobs argument

Question 7 -

Suppose the government wants to reduce the total pollution emitted by three local firms. Currently, each firm is creating 4 units of pollution in the area, for a total of 12 pollution units. If the government wants to reduce total pollution in the area to 6 units, it can choose between the following two methods:

Available Methods to Reduce Pollution

1. The government sets pollution standards using regulation.

2. The government allocates tradable pollution permits.

Each firm faces different costs, so reducing pollution is more difficult for some firms than others. The following table shows the cost each firm faces to eliminate each unit of pollution. For each firm, assume that the cost of reducing pollution to zero {that is, eliminating all 4 units of pollution) is prohibitively expensive.

|

Firm

|

Cost of Eliminating the....

|

|

First Unit of Pollution (Dollars)

|

Second Unit of Pollution (Dollars)

|

Third Unit of Pollution (Dollars)

|

|

Firm X

|

130

|

165

|

220

|

|

Firm Y

|

90

|

115

|

140

|

|

Firm Z

|

600

|

750

|

1,200

|

Now imagine that two government employees proposed alternative plans for reducing pollution by 6 units.

Method 1: Regulation

The first government employee suggests limiting pollution through regulation. To meet the pollution goal, the government requires each firm to reduce its pollution by 2 units.

Complete the following table with the total cost to each firm of reducing its pollution by 2 units.

|

Firm

|

Total Cost of Eliminating Two Units of Pollution

|

|

Firm X

|

|

|

Firm Y

|

|

|

Firm Z

|

|

Method 2 - Tradable Permits

Meanwhile, the other employee proposes using a different strategy to achieve the government's goal of reducing pollution in the area from 12 units to 6 units, This employee suggests that the government issue two pollution permits to each firm. For each permit a firm has in its possession, it can emit 1 unit of pollution. Firms are free to trade pollution permits with one another (that is, buy and sell them) as long as both firms can agree on a price. For example, if firm X agrees to sell a permit to firm Y. at an agreed-upon price, then firm Y would end up with three permits and would need to reduce its pollution by only 1 unit while firm X would end up with only one permit and would have to reduce its pollution by 3 units. Assume the negotiation and exchange of permits are costless.

Because firm Z has high pollution-reduction costs, it thinks it might be better off buying a permit from firm Y and a permit from firm X so that it doesn't have to reduce its own pollution emissions. At which of the following prices is firm Y willing to sell one of its permits to firm 7, but firm X is not? Check all that apply.

Suppose the government has set the trading price of a permit at $218 per permit.

Complete the following table with the action each firm will take at this permit price, the amount of pollution each firm will eliminate, and the amount it costs each firm to reduce pollution to the necessary level. If a firm is willing to buy two permits, assume that it buys one permit from each of the other firms. (Hint: Do not include the prices paid for permits in the cost of reducing pollution.)

|

Firm

|

Initial Pollution Permit Allocation (Units of Pollution)

|

Action

|

Final Amount of Pollution Eliminated (Units of Pollution)

|

Cost of Pollution Reduction (Dollars)

|

|

Firm X

|

|

|

|

|

|

Firm Y

|

|

|

|

|

|

Firm Z

|

|

|

|

|

Determine the total cost of eliminating six units of pollution using both methods, and enter the amounts in the following table. (Hint: You might need to get information from previous tasks to complete this table.)

|

Proposed Method

|

Total Cost of Eliminating Six Units of Pollution (Dollars)

|

|

Regulation

|

|

|

Tradable Permits

|

|

In this case, you can conclude that eliminating pollution is _______ costly to society when the government regulates each firm to eliminate a certain amount of pollution than when it allocates pollution permits that can be bought and sold.

Question 8 -

Suppose a political candidate criticizes a government pollution permit policy that she says lets corporations buy and sell the right to pollute. She argues that our right to breathe and the future of our planet require real regulation instead of this type of government policy.

Which of the following describes why most economists would disagree with her statement?

- A corrective tax would result in a more efficient outcome than either tradable permits or government regulation would.

- Clean air is a fundamental right, and government regulation will allow too much pollution.

- The environment is 50 important that it should be protected as much as possible, regardless of the cost.

- A free market in tradable pollution permits is typically more efficient than government regulation.

Question 9 -

Consider a Lake found in the town of Centre Barnstead, and then answer the questions that follow.

The town has a campground whose visitors use the lake for recreation. The town also has a tannery that dumps industrial waste into the lake. This pollutes the lake and makes it a less desirable vacation destination. That is, the tannery's waste decreases the campground's economic profit.

Suppose that the tannery could use a different production method that involves recycling water. This would reduce the pollution in the lake of levels Bare for recreation, and the campground would no longer be affected. If the tannery uses the recycling method, then the tannery's ecomonic profit is $1,400 per week, and the campground's economic profit is $2,700 per week. If the tannery does not use the recycling method, then the tannery's economic profit is $2,200 per week, and the campground's economic profit is $1,500 per week. These figures are summarized in the following table.

Complete the following table by computing the total profit (the tannery's economic profit and the campground's economic profit combined) with and without recycling.

|

Action

|

Profit

|

|

Tannery (Dollars)

|

Campground (Dollars)

|

Total (Dollars)

|

|

No Recycling

|

2,200

|

1,500

|

|

|

Recycling

|

1,400

|

2,700

|

|

Total economic profit is highest when me recycling production method is ______.

When the tannery uses the recycling method, the campground earns $2,700 - $1,500 = $1,200 more per week than it does with no recycling. Therefore, the campground should be willing to pay up to $1,200 per week for the tannery to recycle water. However, the recycling method decreases the tannery's economic profit by $2,200 - $1,400 = $800 per week. Therefore, the tannery should be willing to use the recycling method if it is compensated with at least $800 per week.

Suppose the campground has the property rights to the lake. That is, the Campground has the right to a clean (unpolluted) lake. In this case, assuming the two firms can bargain at no cost, the tannery will _____ the recycling method and will pay the campground _____ per week.

Now, suppose the tannery has the property rights to the lake, including the right to pollute it. In this case, assuming the two rims can bargain at no eta, the tannery will ______ the recycling method, and the campground will pay the tannery _______ per week.

The tannery will make the most economic profit when _________.

Question 10 -

Correcting for negative externalities - Taxes versus tradable permits

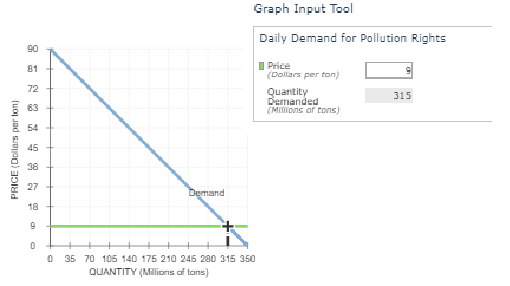

Power stations emit sulfur dioxide as a waste product. This generates a cost to society that is not paid for by the firm; therefore, pollution is a negative externality of power production. Suppose the U.S. government wants to correct this market failure by getting firms to internalize the cost of pollution. To do this, the government can charge firms for pollution rights (the right to emit a given quantity of sulfur dioxide). The following graph shows the daily demand for pollution rights.

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

Suppose the government has determined that the socially optimal quantity of sulfur dioxide emissions is 175 million tons per day.

One way governments can charge firms for pollution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of $____ per ton of sulfur dioxide emitted wit achieve the desired level of pollution.

Now suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimal tax to achieve the desired level of pollution. Instead, it auctions off tradable pollution permits. Each permit entitles its owner to emit one ton of sulfur dioxide per day. To achieve the socially optimal quantity of pollution, the government auctions ort 175 million pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be $_____.

The previous analysis hinges on the government having good information regarding either the demand for pollution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the available information and the poky goal, consider the following scenario:

An environmental study conducted in a particular city suggests that if a chemical plant emits more than 50 minion tons of chemicals each year, the water supply will become contaminated beyond the point where filtration techniques can make it safe for drinking.

If this is as the information the government has, which solution to reduce pollution is appropriate? Check all that apply.

- Tradable permits

- Corrective taxes

Attachment:- Assignment Files.rar