Question 1 - On January 1, 2008, Line Corporation acquired all of the common stock of Staff Company for $300,000. On that date, Staff's identifiable net assets had a fair value of $250,000. The assets acquired in the purchase of Staff are considered to be a separate reporting unit of Line Corporation. The carrying value of Staff's investment at December 31, 2008, is $310,000. The fair value of the net assets (excluding goodwill) at that date is $220,000 and the fair value of the reporting unit is determined to be 260,000.

Required:

1) Explain how goodwill is tested for impairment for a reporting unit.

2) Determine the amount, if any, of impairment loss to be recognized at December 31, 2008.

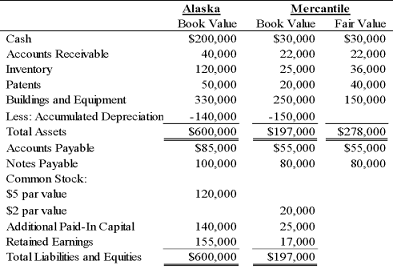

Question 2 - On January 1, 2008, Alaska Corporation acquired Mercantile Corporation's net assets by paying $160,000 cash. Balance sheet data for the two companies and fair value information for Mercantile Corporation immediately before the business combination are given below:

Required: Prepare a combined balance sheet immediately following the acquisition.

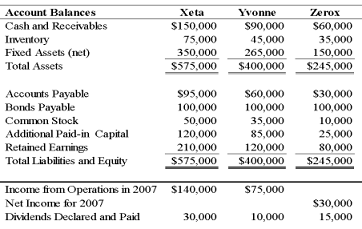

Question 3 - On January 1, 2007, Xeta Corporation acquired 45 percent of the voting common stock of Yvonne Company by issuing common stock with a par value of $50,000 and fair value of $135,000. Immediately after this transaction, Yvonne acquired 30 percent of the voting common stock of Zerox Corporation by issuing bonds payable with a par value and market value of $35,700. On January 1, 2007, the book values of Yvonne's net assets were equal to their fair values except for equipment that had a fair value $48,000 greater than book value and patents that had a fair value $12,000 greater than book value. At that date the equipment had a remaining economic life of ten years and the patents had a remaining economic life of six years. The book values of Zerox's assets were equal to their fair values except for inventory that had a fair value $4,000 in excess of book value and was accounted for on a FIFO basis. Selected balance sheet information at January 1, 2007, and income statement data for 2007 for Xeta Corporation, Yvonne Company, and Zerox Corporation are provided below:

Required:

1) What will be the net income reported by Xeta Corporation for 2008, assuming the equity method is used by both Xeta and Yvonne in accounting for intercorporate investments.

2) Provide all journal entries recorded by Xeta relating to its investment in Yvonne during 2007.

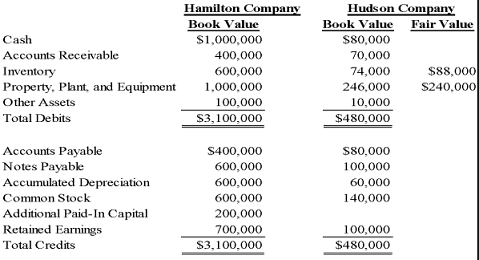

Question 4 - The Hamilton Company acquired 100 percent of the stock of Hudson Company on January 1, 2010, for $308,000 cash. Summarized balance sheet data for the companies on December 31, 2009, are as follows:

The book values of Hudson's assets and liabilities are equal to their fair values, except as indicated. On January 1, 2010, Hudson owed Hamilton $14,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

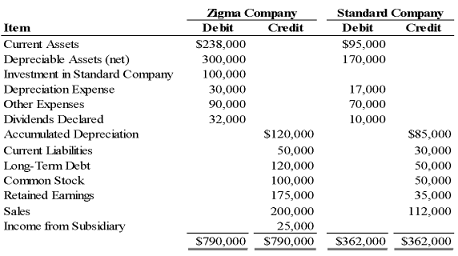

Question 5 - On January 1, 2009, Zigma Corporation acquired 100 percent of Standard Company's common shares at underlying book value. Zigma uses the equity method in accounting for its ownership of Standard. On December 31, 2009, the trial balances of the two companies are as follows:

Required: Prepare the eliminating entries needed as of December 31, 2009, to complete a consolidation workpaper.

Prepare a three-part consolidation workpaper as of December 31, 2009.