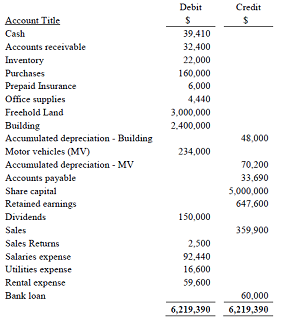

Question - The trial balance of YTP Supplies Pte Ltd ("YTP") was given as at 31 December 20X6:.

Before you prepare the financial statements, you manage to extract out the following additional information.

Additional information:

(i) The 4-year bank loan of $60,000 was entered into on 1 October 20X6. It carries an annual interest of 5% payable on 1 October annually. The first interest payment will be made on 1 October 20X7.

(ii) The $6,000 prepaid insurance was purchased on 1 July 20X6 for a 2-year fire insurance coverage for the building effective 1 July 20X6.

(iii) On 12 December 20X6, the company was informed that one of its customers had severe financial difficulties. The amount owing was $780. The company had not made any allowance for this bad debt.

(iv) On 27 December 20X6, a customer prepaid the company $1,600 in cash for an item to be delivered one week later. The accounts clerk did not record the transaction since the item was not delivered yet.

(v) As at 31 December, salaries amounting to $7,800 remained outstanding. No entry was made for this amount.

(vi) The building was purchased on 1 January 20X5. It was expected to have zero residual value and a useful life of 50 years. The motor vehicles were purchased on 1 January 20X3. They are expected to have zero residual value and a useful life of 10 years.

(vii) YTP adopts a periodic inventory system. A stock count was done and the inventory at year end was $58,300.

Required:

(a) Apply the accrual concept of accounting and prepare all necessary adjusting or additional journal entries as required by the additional information. Journal narratives are not necessary.

(b) Prepare the Statement of Financial Position for YTP as at 31 December 20X6, incorporating all the necessary adjustments.