Process financial transactions and extract interim reports Assignment

Assessment Task 1: Written Questions

Provide answers to all of the questions below:

1. Describe the imprest system of petty cash., including the accounts to which the transactions and the petty cash replenishment will be attributed to.=

2. Explain the concept of accrual accounting.

3. Explain the concept of cash accounting.

4. Explain why a company may elect to use accrual accounting rather than cash accounting method?

5. Explain the difference between an asset and an expense and include an example of each.

6. Explain, in your own words, the procedure of Electronic Funds Transfer at Point of Sale (EFTPOS).

7. When placing a deposit at a bank, identify the proof of lodgement that you need to obtain in order to ensure you are able to trace the deposit if required?

8. What additional security measures could a company use when banking a cheque made out to cash, as opposed to a general cheque?

9. Outline three examples of errors that can be made when processing financial transactions.

10. In your own words, briefly explain the five fundamental principles of the Code of Ethics for Professional Accountants.

11. Briefly describe the purpose of the Tax Agent Services Act 2009 and why it is important for a BAS agent to be aware of this Act.

12. Briefly explain the purpose of the Fair Work Act 2009 and the importance of understanding this Act for an individual working in accounts or bookkeeping.

13. Provide three examples of actions that should be taken at work to meet the requirements of the Privacy Act 1988.

14. List 4 safety/security measures that should be implemented when transporting cash.

15. Describe, in your own words, three important features of a chart of accounts, and list the five categories (excluding contra-accounts) under which all accounts are usually organised.

Assessment Task 2: Petty cash and cash receipts

Task summary - For this assessment task you are required to check petty cash receipts against a petty cash log, recording the transactions in a Petty Cash Book and the General Journal, as well as preparing for the month's Petty Cash reimbursement. You will have to get approval, at a meeting with your assessor, for the Petty Cash vouchers and your General Journal entries before posting these to the Ledger.

You will also be required to check the day's takings, in cash, cheque, and EFTPOS, and then depositing the cash and cheques at the selected deposit facility. You will be expected to discuss the safety and security implications of deposit facility selection with your assessor at the meeting, too.

Required

- Computer and Microsoft Office

- Access to the internet for research

- Petty Cash Vouchers

- Petty Cash Receipts

- Financial Policy and Procedures

- EFTPOS

- Cheques

- Andrew's Workbook Template

Assessment Instructions -

Carefully read the following:

Andrew has been buying and selling timber slabs for some years, and has recently started repairing furniture. The business transactions are still recorded in a cash receipts book, and then transferred to an Excel Workbook, but Andrew intends to move to an electronic accountancy system in the future.

It is the first of May and, as Andrew's bookkeeper, you are to balance the Petty Cash box for the previous month and prepare for its reimbursement. The Petty Cash box and log were started a month ago, so that Andrew can have better oversight of what is being spent by the office staff.

It is also your job to collect and batch the previous day's cash, cheques, and EFTPOS receipts, balancing that against the previous day's transactions.

You will then participate in a meeting with your assessor, who will be roleplaying Andrew. His approval is needed for the month's Petty Cash vouchers and for the Journal before it can be posted to Ledger, as set out in Andrew's Slabs Financial Policy and Procedures.

You will then roleplay the visit to the bank to reconcile the petty cash box and to deposit the previous day's cheques and cash takings.

Petty Cash Log

|

Date

|

Voucher Number

|

Particulars

|

Total Paid

|

Who paid

|

|

Apr 1

|

1001

|

Taxi Fare

|

27.50

|

David

|

|

3

|

1002

|

Ring binders

|

8.80

|

Angela

|

|

8

|

1003

|

Coffee and sugar for staff room

|

28.60

|

Angela

|

|

12

|

1004

|

Fruit for staff room

|

12.30

|

Angela

|

|

18

|

1005

|

Carton of paper for photocopier

|

19.80

|

Angela

|

|

23

|

1006

|

Taxi fare

|

16.50

|

David

|

|

25

|

1007

|

New kettle for staff room

|

26.40

|

Andrew

|

|

25

|

1008

|

Taxi fare

|

25.30

|

Andrew

|

|

29

|

1009

|

Fruit for staff room

|

13.20

|

Angela

|

Complete the following activities:

1. Balance the Petty Cash Log and prepare for reimbursement of the Petty Cash Fund.

Check the petty cash log against the Petty Cash Vouchers and Petty Cash Receipts source documents, then transfer the transactions to the Petty Cash Book Worksheet in Andrew's Workbook Template. Include the reimbursement, which is due to happen later that day.

Make the General Journal entries for the Petty Cash fund.

2. Batch and total the cash, leaving a $300.00 float for the cash register.

|

Denomination

|

Quantity

|

Value

|

|

Notes

|

|

|

|

$100

|

1

|

|

|

$50

|

3

|

|

|

$20

|

8

|

|

|

$10

|

6

|

|

|

$5

|

5

|

|

|

Coins

|

|

|

|

$2

|

18

|

|

|

$1

|

14

|

|

|

50c

|

10

|

|

|

20c

|

21

|

|

|

10c

|

13

|

|

|

5c

|

16

|

|

|

Total

|

|

|

3. Batch and total the cheques

4. Total the EFTPOS transactions

5. Enter previous day's transactions into the Cash Receipts Book in the Andrew's Workbook Template, and then enter the figures into the General Journal.

6. When you have accounted for the day's trading and the month's petty cash, organise a meeting with Andrew (your assessor).

Send your assessor an email requesting a meeting to look at, and authorise, the Petty Cash vouchers for the last month and the Journals.

The text of the email should include:

The table you have filled out for activity 2 above.

- the previous day's cash takings, total cheques, total EFTPOS transactions and total revenue for the day.

- the total value of cash that you intend to deposit in the bank.

- the amount that will be necessary for reimbursement of Petty Cash.

The covering email should be written polite and technically correct English. Terminology should be used accurately, but appropriately.

Attach your Andrew's Workbook to the email.

7. At the meeting you will be expected to:

- Give the Petty Cash Vouchers and Petty Cash Receipts to your assessor for authorisation.

- Make any changes to your Workbook entries that are requested.

- Obtian authorisation to post the Journals to Ledger.

- Detail what cash and cheques you will be bringing to the bank, roleplaying the process of depositing these and receiving a receipt.

- Give the amount of cash that you wish to withdraw for the Petty Cash Reconciliation, also roleplaying this and your receipt of the withdrawal slip.

- Describe how you would file these two documents.

During the meeting, you will be required to demonstrate effective communication skills as follows:

- Use of appropriate style (formal), tone (encouraging, respectful) and vocabulary (professional, business language) for the meeting

- Active listening skills

- Asking questions and listening to responses to clarify understanding

8. At the meeting, your assessor will ask you about safety and security in relation to the company's deposit facilities.

Before attending the meeting, research the safety and security measures that may be appropriate for a business the size of Andrew's Slabs. Ensure that you have recommendations on:

- which deposit facilities are appropriate

- measures that can be taken to enhance safety and security.

9. When the meeting has been completed, reconcile the banking documentation with the company's records.

- Adjust the Petty Cash transactions in the Petty Cash Book and the Journals to reflect the information that Andrew has given you.

- Post the approved Journal entries to Ledger

- Record the day's trading in the Cash Receipts Book within the timeframe given in the Policy and Procedures, ensuring that the figures reconcile with the banking documentation.

10. Send Your revised Andrew's Slabs Workbook to your assessor as an email attachment. The email itself should refer to the meeting and its outcomes, and should give s short summary of changes you have made to the Workbook.

Assessment Task 3 - Instructions

Carefully read the following

It is the first of August in your current financial year, and Andrew is interested in using a simple version of MYOB to keep the company's accounts. Andrew has asked you, as the Accounts Clerk, to record the company's details and transactions into the MYOB framework, and extract interim reports as requested by Andrew.

Many customers are walk-ins, as the workshop is close to the Tyagarah CBD, but Andrew also has several regular customers who purchase from him to resell in their retail stores. These customers can purchase on credit as set out in the Financial Policy and Procedures. You will also be asked to write invoices for orders that these customers have made.

Complete the following activities:

1. Open an online MYOB Essentials account.

Go to the following website: MYOB

Start a free 30-day trial of MYOB Essentials, or the simplest program that is offered for a free trial. Use the option "I sell products and services".

If you do not wish to use your email address to register for the free trial, you can create a new email for this purpose.

2. Enter Andrew's Slabs' details from Andrew's Accounts into MYOB.

Accept the chart of accounts suggested, and modify this as set out in Andrew's Accounts, entering the opening balances as appropriate.

Inactivate the accounts in MYOB that are not listed in Andrew's Accounts.

Under GST settings enter Accrual accounting, Quarterly reporting, BAS lodgement by paper.

Enter details of Andrew's Slabs' customers and suppliers from Andrew's Accounts into MYOB.

3. Enter the sales and expenses in Andrew's Slabs Transactions July.

After a few unfortunate experiences with cheques not being honoured, Andrew decided to stop taking them at the end of the last financial year. There were also multiple problems with Andrew's Slabs' EFTPOS system, so no EFTPOS transactions could be carried out since the end of June. Consequently, all of the transactions listed in Andrew's Slabs Transactions July were cash sales.

In the Notes window write "Cash Sales July"

4. The following special transactions occurred in July also. Enter them into MYOB.

- July 10 Upholstery pressure stapling machine $875.00

- July 18 Standing wood drill $1,350.00

- July 27 Andrew withdrew from business $2,000

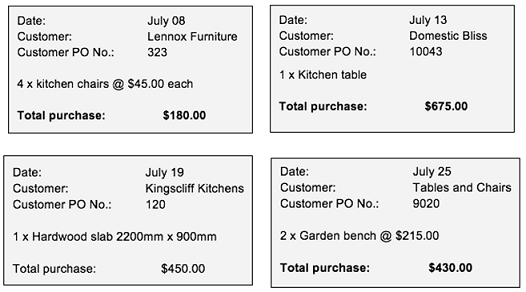

5. The following orders have been picked up by customers. Write an invoice for each in MYOB.

Make sure that the invoices are prepared as set out in the Financial Policy and Procedures.

As many of Andrew's products are individual pieces, and are priced as such, do not use the Item column for items, but use the description column.

Use the invoice number suggested by MYOB.

Before saving the invoices, check them against the customer orders again, correcting any errors you find.

Save a pdf of the invoices to your desktop. File this document as set out in the Financial Policy and Procedure by creating an appropriately named folder on your desktop.

6. Extract a trial balance and a bank transactions report from MYOB. Check their figures against the data you have entered to ensure that it is accurate. If there any errors, correct these. Save both as pdf documents, filing them as you did with the invoices, and take a screen shot of the opened Folder.

7. To ensure that the relevant information is understood easily by Andrew, he has asked you to create a small table that shows, for each month:

- Total income

- Cost of sales

- Total expenses

- Net profit

- Total Assets

- Total liabilities

The table should have a row for each of these values, and a column for each month for the next half a year. It will be updated every month, and sent to Andrew as part of an email. This will be a separate system of data entry that you will maintain yourself, given that the figures cannot be automatically imported from MYOB.

8. Write an email to Andrew (your assessor).

The email should be written in polite and technically correct English, asking your assessor, in the role of Andrew, to check through the attached documents and to give his opinion as to the benefits of using MYOB.

Place the table within the email's text, summarising how it can be updated monthly to keep Andrew abreast of the company's performance.

Attach the pdf documents you generated in activities 3 and 4 to this email, as well as the screen shot you have taken of the files and folder.

Attachment:- Assignment Files.rar