Problems on Risk, Return and Discount Rates

Problem 1: DETERMINING THE CORRECT COST OF CAPITAL FOR AN INVESTMENT PROJECT

Benchmark Inc. is an all-equity financed firm with a cost of capital of 8%. The firm has four investment projects available with returns depending on the state of the economy. Relevant information on each of the projects is summarized below.

|

State

|

Probability

|

Project A

|

Project B

|

Project C

|

Project D

|

|

1

|

0.25

|

0.10

|

0.12

|

0.13

|

0.24

|

|

2

|

0.25

|

0.08

|

0.10

|

0.11

|

0.17

|

|

3

|

0.25

|

0.07

|

0.09

|

0.06

|

0.07

|

|

4

|

0.25

|

-0.03

|

0.07

|

0.04

|

0.05

|

|

Beta

|

|

0.40

|

0.60

|

0.80

|

1.50

|

The risk free rate is 4% and the market risk premium is 6%. If the firm has sufficient capital to invest and the projects are not mutually exclusive, which of these projects should the firm undertake? Which projects would you pick based on the company cost of capital? Motivate your answers and show your calculations.

Problem 2: DETERMINING THE ASSET BETA FOR KRAFT FOODS

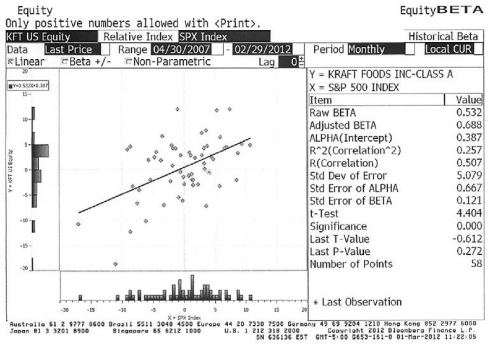

The following is the Bloomberg beta page for Kraft Foods, using five years of monthly data.

Kraft has 1.8 billion shares, trading at $40 a share and $28 billion in total debt outstanding in January 2012. Over the five years of the regression, Kraft had an average market debt to equity ratio of 20%. The marginal tax rate is 35%. Assuming that the regression beta (raw beta) is a reasonable estimate of the company's beta over the regression period and the firm's debt beta equaled 0.10, what is the appropriate estimate for the unlevered or asset beta for the company?

Problem 3: DETERMINING THE COST OF CAPITAL FOR THE MIDWEST REAL ESTATE COMPANY

The total market value of the common stock of the Midwest Real Estate Company is $9 million, and the total value of its (risk free) debt is $6 million. The company is headquartered in St. Louis. The treasurer of the company estimates that the beta of the stock equals 1.5 and that the expected market risk premium equals 6%. The Treasury Bond rate is 4%. Assume that the corporate tax rate equals 35%. With this information, please answer the following questions.

(i) Calculate the required return on the Midwest Real Estate Company's stock.

(ii) What is the beta of the company's existing portfolio of assets?

(iii) Calculate the company's cost of capital.

(iv) Suppose the company wants to diversify into the manufacturing of Arch-shaped souvenirs. The beta of unleveraged souvenir manufacturers is 1.2. Estimate the required return on Midwest's new venture assuming that the capital structure of the firm does not change.

Problem 4: DETERMINING THE COST OF CAPITAL FOR AMALGAMATED PRODUCTS

Amalgamated Products has the following three operating divisions:

|

Division

|

Percentage of firm value

|

|

Food

Electronics

Chemicals

|

50

30

20

|

To estimate the cost of capital for each division, Amalgamated has identified the following three principal competitors:

|

Competitor

|

Estimated equity beta (βE)

|

Debt/(Debt + Equity)

|

|

United Foods

|

0.80

|

0.30

|

|

General Electronics

|

1.60

|

0.20

|

|

Associated Chemicals

|

1.20

|

0.40

|

Assume for now that these betas are accurate estimates and that the debt of Amalgamated Products and its three competitors' debt is risk free. Furthermore, we assume that there are no taxes. With this information, please answer the following questions.

(i) Estimate the asset beta of each of Amalgamated Products' divisions.

(ii) Assume that Amalgamated's debt ratio (in market value terms) equals 0.40. Calculate Amalgamated Products' equity beta.

(iii) Assume that the risk free interest rate equals 4% and the expected return on the market index equals 10%. Estimate the cost of capital of the company overall and for each of its divisions, assuming that the divisions each have similar leverage as the firm.

Problem 5: GENERAL MOTORS AND HUGHES AIRCRAFT CORPORATION

In 1989 General Motors (GM) was evaluating the acquisition of Hughes Aircraft Corporation. Recognizing that the appropriate discount rate for the projected cash flows of Hughes was different from its own cost of capital, GM assumed that Hughes had approximately the same risk as Lockheed or Northrop, which had low risk defense contracts and products that were similar to Hughes. Suppose the following inputs were available at the time of the evaluation:

|

Comparison

|

βE

|

D/E

|

|

General Motors

|

1.20

|

0.40

|

|

Lockheed

|

0.90

|

0.90

|

|

Northrop

|

0.85

|

0.70

|

The target debt/equity ratio for Hughes's acquisition was estimated to be 1 (in market value terms). Hughes's projected net cash flow in year 1990 was $300 million. The growth rate of Hughes' cash flows was estimated to be 5% per year indefinitely. The risk free interest rate rf equaled 8%, and the market risk premium equaled 6%. For simplicity, the debt of all companies was assumed to be risk free. The corporate tax rate equaled 34%. With this information answer the following questions:

(i) Calculate the asset betas of the comparison firms, Lockheed and Northrop, using the pure play approach.

(ii) Estimate the asset beta and the equity beta for the Hughes acquisition.

(iii) What is the relevant cost of capital for the Hughes acquisition and what is the value of Hughes based on this cost of capital?

(iv) What would be the value of Hughes Aircraft Corporation if GM's cost of capital would be used as a discount rate? What are your conclusions?

Problem 6: DETERMINING THE COST OF CAPITAL FOR PEPSI CO.

Consider the following information for Pepsi Co., as of the Fall of 2006 (see the next page). Use this information to determine the company's cost of capital and the firm's business risk (or asset beta). You can use the following additional information (also as of the Fall of 2006):

- The firm's excess cash reserves at the end of the 3rd quarter of 2006 are $2,075 million.

- The current 10-year T-Bond rate equals 4.6%

- The market risk premium equals 6.4%

- Pepsi Co.'s overall bond rating is A+

- The yields on 10-year AAA-, AA- and A-rated bonds are 5.49%, 5.33% and 5.42% respectively.

- Pepsi Co.'s marginal corporate tax rate equals 35%.

Attachment:- Assignment File.rar