Problem 1:

Come-On-In Manufacturing produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs (indirect costs) has been direct labor dollars. For 2010, Come-On-In compiled the following data for the two products:

Standard Deluxe

Sales units 400,000 units 50,000 units

Sales price per unit $475.00 $650.00

Direct material and labor costs per unit $130.00 $180.00

Manufacturing support costs per unit $120.00 $80.00

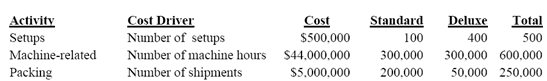

Last year, Come-On-In Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information (indirect cost activities) for 2010:

Required:

a. Using the current system, what is the estimated value for the following?

1. Total cost of manufacturing one unit for each type of door?

2. Profit per unit for each type of door?

b. Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit) than the standard door ($120 per unit). What is a likely explanation for this? Direct your response in terms of the current allocation base used and how the recently adopted robotics system is changing the past cost allocation system.

c. Is there any logic in the number of set ups per type of product? (The Standard Product has 100 setups while the Deluxe Product has 400 setups).

d. Using the activity-based costing data presented above,

1. Compute the cost-driver rate for each overhead activity.

2. Compute the revised manufacturing overhead cost per unit for each type of entry door.

3. Compute the revised total cost to manufacture one unit of each type of entry door.

e. Is the deluxe door as profitable as the original data estimated? Why or why not?

Problem #2

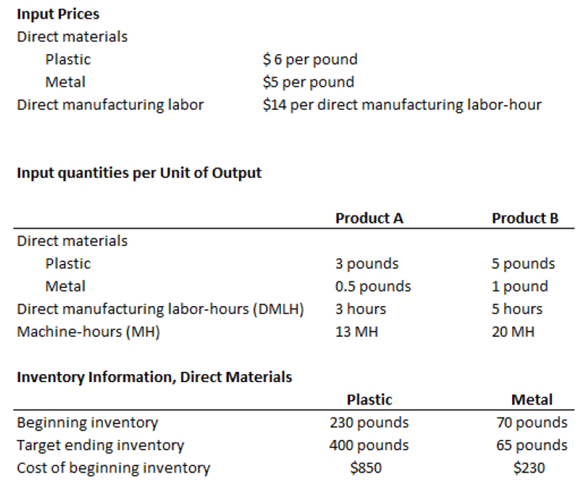

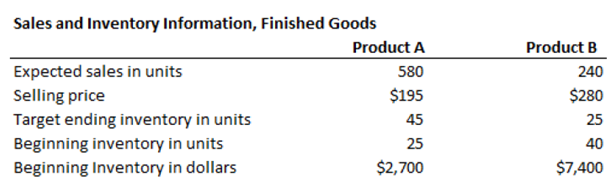

Best Products Company makes two products, Product A and Product B. They are both made of plastic and metal. Information for the two products for the month of April is given in the following tables:

Best Products accounts for direct materials using a FIFO cost flow assumption.

Pet Luggage uses a FIFO cost flow assumption for finished goods inventory.

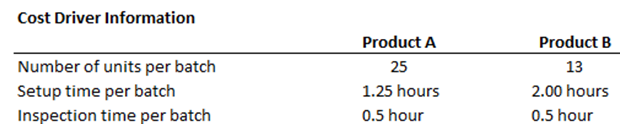

Best Products uses an activity-based costing system and classifies overhead into three activity pools:

Setup, Processing and Inspection. Activity rates for these activities are $130 per setup hour, $5 per machine-hour, and $20 per inspection-hour, respectively. Other information follows:

Nonmanufacturing fixed costs for March equal $32,000. The only variable nonmanufacturing costs are sales commission, equal to 1% of sales revenue.

Required:

Prepare the following for April:

1. Revenues budget

2. Production budget in units

3. Direct material usage budget and direct material purchases budget

4. Direct manufacturing labor cost budget

5. Manufacturing overhead cost budgets for each of the three activities

6. Budgeted unit cost of ending finished goods inventory and ending inventories budget

7. Cost of goods sold budget

8. Budgeted income statement (ignore income taxes).

Problem #3

Wilson's Winter Woolens manufactures jackets and other wool clothing. A certain designed ski parka requires the following:

Direct materials standard: 2 square yards at $13.50 per yard

Direct manufacturing labor standard: 1.5 hours at $20.00 per hour

During the third quarter, the company made 1,500 parkas and used 3,150 square yards of fabric costing $39,375. Direct labor totaled 2,100 hours for $45,150.

Required:

a. Compute the direct materials price and efficiency variances for the quarter.

b. Compute the direct manufacturing labor price and efficiency variances for the quarter.

Discussion Questions

1. What is ABC Costing and how can it make a difference in the way a company prices its products?

2. Discuss the cost hierarchy categories. Why do we categorize cost this way?

3. Discuss the importance of making a budget.

4. Discuss the reason for budgeting in multinational companies.

5. Discuss the different types of Standards that are considered when dealing with variances.

6. What is a Flexible Budget? How is it realized? What is its function in term of variances? What is a Static Budget?

7. Discuss the three variance levels. What is the purpose of having these levels?

8. Discuss what is the significance of a Variable Overhead Flexible Budget Variance of $10,500 U?