PROBLEM 1: Contribution Format versus Traditional Income Statement

Marwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, $2,450 each from the manufacturer. Marwick's Pianos, Inc., sells the pianos to its customers at an average price of $3,125 each. The selling and administrative costs that the company incurs in a typical month are presented below:

| Costs |

Cost Formula |

| Selling: |

|

| Advertising .................................... |

Depreciation of office equipment $700 per month |

| Sales salaries and commissions ...... |

5950 per month, plus 8% of sales |

| Delivery of pianos to customers ..... |

530 per piano sold |

| Utilities..................................................... |

$350 per month |

| Depreciation of sales facilities......... |

5800 per month |

|

|

| Administrative: |

$2,500 per month |

| Executive salaries........................... |

5400 per month |

| Insurance................................................. |

51,000 per month. plus $20 per piano sold |

| Clerical..................................................... |

5300 per month |

During August. Marwick's Pianos. Inc.. sold and delivered 40 pianos.

Required:

1. Prepare an income statement for Marwick's Pianos. Inc.. for August. Use the traditional for¬mat, with costs organizes by function.

2. Redo requirement 1 above, this time using the contribution format, with costs organized by behavior. Show costs and revenues on both a total and a per unit basis down through contribu-tion margin.

3. Refer to the income statement you prepared in requirement 2 above. Why might it be mislead-ing to show the fixed costs on a per unit basis?

PROBLEM 2: High-Low Method; Predicting Cost

Nova Company's total overhead cost at various levels of activity are presented below:

| Month |

Machine-Hours |

Total Overhead Cost |

| April |

70,000 |

$198,000 |

| May |

60,000 |

$174,000 |

| June |

80,000 |

$222,000 |

| July |

90,000 |

$246,000 |

Assume that the total overhead cost above consists of utilities, supervisory salaries, and main-tenance. The breakdown of these costs at the 60,000 machine-hour level of activity is:

Utilities (variable) $ 48.000

Supervisory salaries (fixed) 21.000

Maintenance (mixed) 105.000

Total overhead cost $174,000

Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements.

Required:

1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: to do this, it may be helpful to first determine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs!)

2. Using the high-low method, estimate a cost formula for maintenance.

3. Express the company's total overhead cost in the linear equation form Y = a + LX.

4. What total overhead cost would you expect to be incurred at an activity level of 75,000 machine-hours?

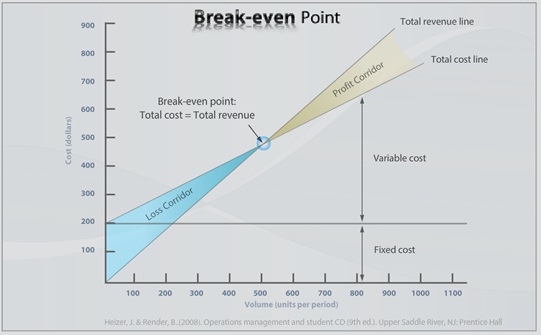

PROBLEM 3 Changes in Fixed and Variable Expenses: Break-Even and Target Profit Analysis

Neptune Company produces toys and other items for use in beach and resort areas. A small. inflat-able toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $3 per unit. Enough capacity exists in the company's plant to produce 16.000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.25. and fixed expenses associated with the toy would total 535.000 per month.

The company's Marketing Department predicts that demand for the new toy will exceed the 16,000 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of S1.000 per month. Variable expenses in the rented facility would total 51.40 per unit. due to somewhat less efficient operations than in the main plant.

Required:

1. Compute the monthly break-even point for the new toy in unit sales and in dollar sales.

2. How many units must be sold each month to make a monthly profit of $12.000?

3. If the sales manager receives a bonus of 10 cents for each unit sold in excess of the break-even point, how many units must be sold each month to earn a return of 25% on the monthly invest-ment in fixed expenses?