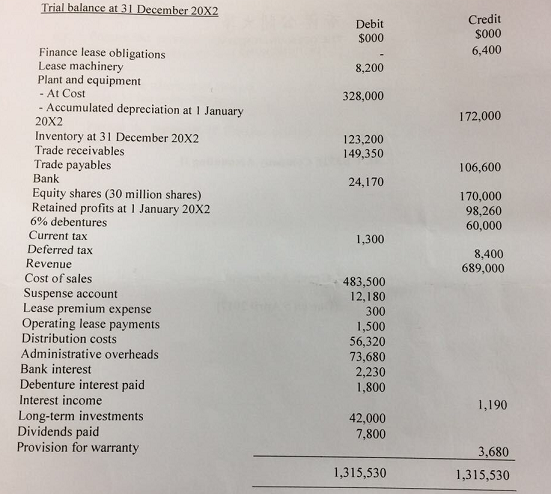

Problem - Sunshine Ltd ("Sunshine") is in the business of designing, manufacturing and supplying of various types of glass products for decoration, architecture and residence uses. Diana Lo, the accountant, is responsible for preparing the financial statements using the financial information below.

The following notes are also relevant:

1. The equity shares in the trial balance above include 5 million rights issue shares at $1.60 on 1 August 20X2. The market price of the ordinary share was $2.50 immediately before the rights issue. Sunshine declared a bonus dividend of 1 for every 10 shares held on 20 February 20X3.

2. On 1 October 20X2, one-fifth of the 6% debentures were redeemed at par and six months' outstanding loan interest was paid. Sunshine has debited the debenture redemption account for the cash payment for the capital redemption amount and interest outstanding. Debenture interest is payable half-yearly in arrears on 1 January and 1 July.

Sunshine entered into two leases in 20X2 and both leases (refer notes 3 and 4) were recorded in accordance with HKAS 17:

3. On 1 January 20X2, Sunshine leased a specialized machine under a six-year non-cancellable lease agreement. Title will be transferred to Sunshine for $500,000 at the end of the lease term. Equal annual payments of $1.8 million due on 31 December each year provides lessor with annual return of 9.68%. The fair value of the machinery is $8.2 million and expected useful life of the machine is eight years. Sunshine has classified the lease as finance lease at the inception of the lease terms. Sunshine adopted a straight-line depreciation for the leased machinery.

The finance lease obligations in the trial balance is reconciled to the fair value of the leased plant as follows:

$000

Fair value 8,200

Less: First rental payment (1,800)

6,400

The depreciation on other non-current assets are calculated at 15% using a reducing-balance method based on the year-end assets value. Depreciation on all non-current assets is regarded as part of cost of sales.

4. Sunshine signed an operating lease for a showroom on 1 January 20X2. The operating lease payments represent an annual payment in advance of $1.5 million. Sunshine also paid $300,000 premium to the lessor for the interior design of the showroom on 1 January 20X2. The lease is for three years and operating lease expenses should be included in distribution expense.

5. At 31 December 20X2. Sunshine decided to measure the leased plant in note 3 using the revaluation model. A professional valuation received on 1 March 20X3 showed the fair value of the specialized machinery is $1.3 million in excess of its carrying amount on 31 December 20X2. The revaluation will not affect the tax base of the machine. Corporate tax rate is 20%.

6. A provision for current tax for the year ended 31 December 20X2 of $3.5 million is required. The balance on current tax in the trial balance above represents the under/over provision of the tax liability of the year before. At 31 December 20X2, the total taxable timing difference outstanding (excluding the tax effect arising in note 5, if any) amounted to $48 million.

7. Sunshine sold products with one-year warranty. At year end, the management, based on past experience, estimated that the warranty cost would be approximately 0.5% of the total sales revenue.

Required -

(a) Briefly explain how the above notes (1) to (7) should be dealt with in the financial statements. Show your calculations are applicable.

(b) Calculate basic earnings per share of Sunshine for the year ended 31 December 20X2.

(c) Prepare the statement of profit or loss and other comprehensive income for Sunshine for the year ended 31 December 20X2.

(d) Prepare the statement of changes in equity for Sunshine for the year ended 31 December 20X2.

(e) Prepare the statement of financial position of Sunshine as at 31 December 20X2.