problem 1: On December 31, 20x7, the Jill Corporation issued $20,000,000 of 15 year face value bonds. The bonds pay interest on June 30 and December 31 of every year. The coupon rate is 7.8% and the yield to maturity is 8.4%.

a) What are the proceeds received on the bond issue on December 31, 20x7?

b) Prepare the journal entries for the year 20x8 to record the bond issue and interest expense.

c) Repeat (a) and (b) assuming that the yield to maturity is 7%.

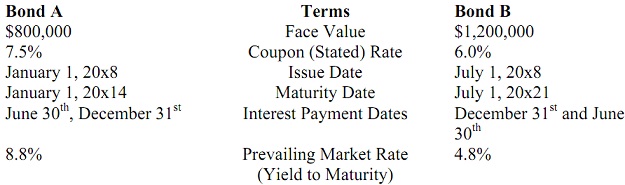

problem 2: The XYZ Company, based on increasing demand is planning an expansion. To facilitate this the company has issued the following two bond issues:

What is the issue price for Bond A and B?

problem 3: Howard Corporation is a publicly owned company whose shares are traded on the TSE. At December 31, 20x4, Howard had unlimited shares of common shares authorized, of which 15,000,000 shares were issued. The shareholders' equity accounts at December 31, 20x4, had the following balances:

Common shares (15,000,000 shares) $230,000,000

Retained earnings 50,000,000

During 20x5, Howard had the following transactions:

a) On February 1, a distribution of 2,000,000 common shares was completed. The shares were sold for $18 per share.

b) On February 15, Howard issued, at $110 per share, 100,000 of no-par value, $8, cumulative preferred shares.

c) On March 1, Howard reacquired and retired 20,000 common shares for $14.50 per share.

d) On March 15, Howard reacquired and retired 10,000 common shares for $20 per share.

e) On March 31, Howard declared a semi-annual cash dividend on common shares of $0.10 per share, payable on April 30, 20x5, to shareholders of record on April 10, 20x5. (Record the dividend declaration and payment.)

f) On April 15, 18,000 common shares were reacquired and retired for $17.50 per share.

g) On September 30, Howard declared a semi-annual cash dividend on common shares of $0.10 per share and the yearly dividend on preferred shares, both payable on October 30, 20x5, to shareholders of record on October 10, 20x5.

(Record the dividend declaration and payment.)

Required: Prepare journal entries to record the various transactions. Round per share amounts to two decimal places.