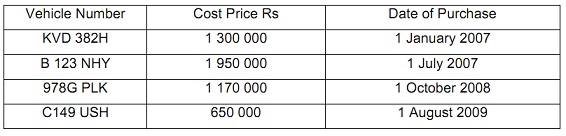

problem 1: Lucy Kim is in the car hire business. The following information came from her Fixed Asset Register on 31 December 2009:

On 31 March 2009, she sold the car which had been bought on 1 July 2007 for Rs 1 950 000, for the sum of Rs 1 137 500.

All acquisitions were paid for on the date of purchase by cheque, except for the 1 August 2009 car which was bought on credit from Car Ltd. All Vehicles are depreciated at 20% per annum using the straight line method and is time apportioned for the number of months of use.

Required:

A) For the year ended 31 December 2009 draw up:

i) The Vehicle Account

ii) The Provision for Depreciation Account

iii) The Disposal Account and

iv) The Balance Sheet extract for the years 2007, 2008 and 2009.

B) Briefly define the term ‘depreciation’ and describe why there is a need to depreciate non-current assets?

problem 2: The following information was extracted from the books of William Noel for the year ended 30 April 2009.

Rs

Purchases Ledger Balance as at 1 May 2008 43 120

Credit purchase for the year 824 140

Credit purchases returns 12 400

Cheques paid to creditors 745 980

Cash purchases 8 940

Discount received on credit purchases 31 400

Credit balances transferred to sales ledger accounts 5 210

The total of the balances in Noel’s purchases ledger amounts to Rs 67 660, which doesn't agree with the closing balance in the Control account.

The following errors were then discovered:

1) Discount received had been overstated by Rs 1 000.

2) A credit purchases invoice for Rs 2 040 had been completely omitted from the books.

3) The purchases ledger account had been understated by Rs 100.

4) A credit balance of Rs 850 in the purchases ledger had been set off against a contra entry in the sales ledger, but no entry had been made in the control accounts.

5) A payment of Rs 1 450 had been debited to the creditor’s account but was omitted from the bank account.

6) A credit balance of Rs 3 210 had been omitted from the list of creditors.

Required:

a) Prepare a Purchases Ledger Control Account for the year ended 30 April 2009.

b) describe why it is useful to maintain a control account in respect of both trade receivables and trade payables.

c) describe briefly how a contra entry might arise.