Part -1:

Revision questions:

1. Using an example if necessary, explain how heteroscedasticity robust standard errors can be obtained in the context of linear regression models. State carefully any assumptions you may have made.

2. Write a short essay on the use of the bootstrapping method to obtain robust standard errors of estimated regression coefficients.

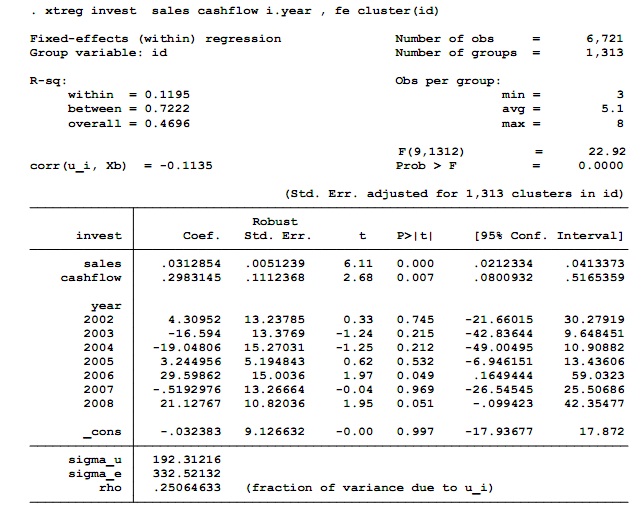

3. Consider the following panel data investment model

investit = β0 + β1salesit + β2cashit + ui + Dt + εit

where i=1,....,1313 and t = 2001, ...,2008 index firms and year respectively, invest is log of investment, sales is sales revenue, cash is log of cash flow, D is a vector of time dummies, u denotes firm-specific effects and s is a possibly heteroscedastic and within-firm serially correlated error term. Interpret the following regression results, and explain in detail how the regression coefficients and their standard errors are obtained.

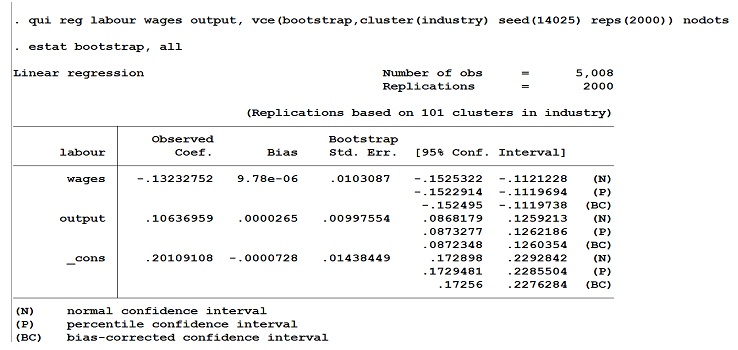

4. Consider the following firm level labour demand model

labouris = β0 + β1wageis + β2outputis + εis

where i indexes firms and s denotes the industry the firm belongs to. It is thought that firms in the same industry tend to face the same labour market conditions. The regression results are reported where the standard errors of the regression coefficients are obtained by bootstrap method are reported below. Explain how the bias terms are calculated, and the normal and percentile confidence intervals constructed.

Part -2: Revision questions:

1. Write short essays on the following topics using empirical example if necessary

a. The definition and interpretation of average treatment effect (ATT); average treatment effect on the treated (ATE); and average treatment effect on the non-treated (ATN).

b. The fundamental problem of causal inference

c. Potential problems in randomisation studies.

d. The bias of the naïve difference-in-means estimator in observational studies.

e. The stable units treatment values assumption in the estimation of treatment effects.

f. Covariate balance tests in propensity-score matching models.

g. The meaning and significance of propensity score overlaps.

2. Show that under randomisation the sample difference-in-means is an unbiased estimator of ATE, ATT and ATN.

3. Using a suitable empirical example discuss how the difference-in-differences strategy can be used to estimate the causal effects of an exogenous program. State carefully any assumptions you may have made, and discuss the possible consequences of those assumptions being violated.

4. Using am empirical example, explain the importance and ways of conducting covariate balancing tests in treatment effects estimation with observational data.

5. Discuss the principles behind two propensity score matching estimators of your choice.

6. Prove that IPW is unbiased estimator of the ATE, stating any assumption you may have made.

7. Using an empirical example, describe the practical implementation of the doubly robust treatment effects estimator.

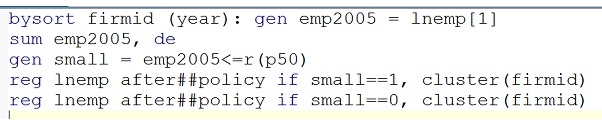

8. This is an empirical exercise, you need to access the dataset subsidy.dta on which the diff-in-diffs example in the lecture was based.

First divide the sample into two sub-sample depending on whether firm employment in 2005 is below or above the sample median employment in 2005; and then carry out the difference-in-differences analysis considered in the lecture on each subsample. Write a short report on your findings, including any assumptions you may have made and your views on the feasibility of the assumptions, if any.

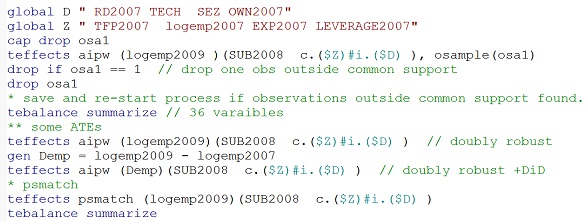

9. The extended empirical example discussed in the last section is based on an example dataset named asp exampledata.dta. Use this data to replicate some of the results shown in the notes, and then to extend the analysis. Possible directions of extension include:

a. Re-specifying the propensity score model (for both binary and multivalued treatment cases) with the aim of achieving better covariates balance. Re-specification can be done in terms of the choice of covariates functions (e.g. nonlinear interactions), as well the parametric model used to estimate the propensity scores (e.g. probit model)

b. Considering a binary (R&D) and a fractional (exporting intensity) outcome variables.

c. Experimenting with different estimators (e.g. RA and nearest 3 neighbours estimators).

d. Contrasting ATE and ATT estimates when feasible.