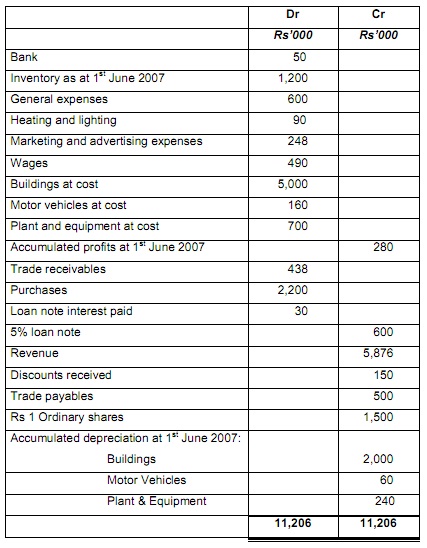

problem 1: You have been given with the following trial balance as at 31 May 2008 for a limited liability company termed Macdillon.

The given notes are relevant:

A) Inventory at 31st May 2008 was valued at Rs 800,000.

B) Marketing and advertising expenses comprise Rs 6,000 paid in advance for a marketing campaign which will start in June 2004. Marketing and advertising expenses must be allocated to administrative expenditures.

C) There are wages outstanding of Rs 10,000 for the year ended 31st May 2008.

D) A customer ceased trading owing the company Rs 38,000; the debt is not expected to be recovered.

E) The allowance for doubtful debts is to be established amounting to 5% of trade receivables.

F) Depreciation is to be given for as follows:

a) Buildings at 5% per annum on their original cost, allocated 50% to cost of sales, 20% to distribution costs and 30% to administrative expenses.

b) Motor vehicles at 25% per annum of their written-down value, allocated to distribution costs.

c) Plant and equipment at 20% per annum of their written-down value, allocated to cost of sales.

G) No dividends have been paid or declared.

H) Income tax of Rs 250,000 is to be given for the year.

I) The audit fees are estimated to be Rs 20,000.

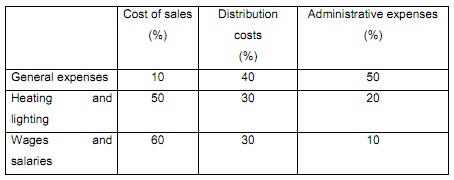

J) The expenses listed below must be apportioned as shown:

Required:

Make the following financial statements for the year ended 31 May 2008 for Macdillon in accordance with IAS 1 Presentation of Financial Statements:

I) An Income Statement

II) A Statement of Financial Position (Balance Sheet)

problem 2: As per IAS1, preparation of financial statements is based, inter-alia, on the given concepts:

a) Going Concern

b) Accruals basis of accounting

c) Consistency of presentation

d) Materiality

Required: In brief describe the above-mentioned concepts.