Question 1

Frank's machine shop operates 250 days per year. Frank sells 5,000 units per year of his most popular item, a specialty gear. The set-up cost for this gear is £100 and the monthly unit cost of holding inventory is 1% of the production cost per unit, which is £50. The lead time is 10 days. When the gear is being produced, the shop can make 80 gears per day (Hint: You should use the production model for inventory management.).

Complete the following:

- How many gears should be produced in each run and at what minimum cost?

- What is the cycle time?

- Find the reorder point.

- Draw a graph to depict inventory level against time and show on it the quantities found above. Also, what is the maximum inventory level?

Question 2

For this part of the Individual Project, you need to use the POM-QM for Windows software:

- Read Appendix IV of the Operations Management (Heizer & Render, 2011) textbook.

- Launch the POM-QM for Windows software and from the main menu select Module, and then Materials Resource Planning.

- Program the MRP for the Individual Project Problem below and solve it with the use of POM-QM for Windows. (Refer to Appendix IV in the Heizer and Render (2011) textbook.)

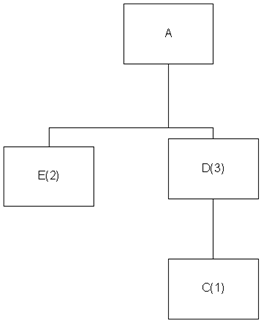

The product structure tree for the finished product A is given below.

The marketing department is estimating product A's demand to be 60 units for week 4 and 50 units for week 6. There is a scheduled receipt of 75 units for component D at the beginning of week 2. Various other MRP related information for the finished products and the components are provided below.

|

|

A

|

C

|

D

|

E

|

|

On hand

|

12

|

170

|

9

|

5

|

|

Lead time

|

2

|

2

|

1

|

1

|

|

Lot size

|

LFL

|

150+

|

multiples of 40

|

multiples of 22

|

Provide the MRP tables for all the finished products and the components for the next six weeks.