problem1)

Users of financial statements need useful information to make sound economic decisions. List five (5) users of financial statements and for each user listed identify one possible economic decision they might make through use of financial statements. (E.g. Employees – Require financials to identify if the entity would operate as a going concern thus providing job security and to establish whether their salaries will be paid to them.)

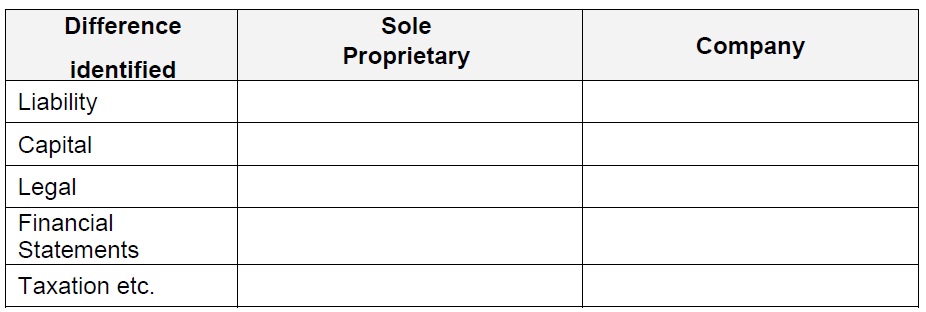

1.2 In South Africa we have differernt forms of business ownership available. Identify five (5) differences between a ‘sole proprietary’ and a ‘public company’. (It is suggested you tabulate the differences using the suggested topic headings provided below.)

1.3 Name and clearly identify three (3) current asset accounts and two (2) current liability accounts.

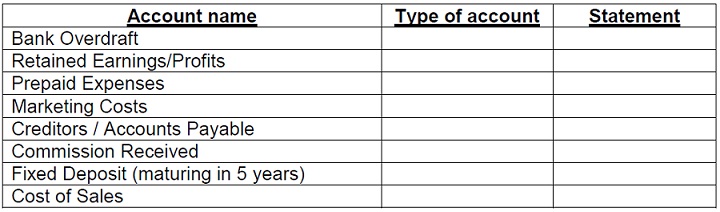

problem2) – ACCOUNT CLASSIFICATION

For each of the accounts listed below you are required to state what type of account they would be classified as [current asset (CA), current liability (CL), expense (E), non-current asset (NCA), non-current liability (NCL), Income (I) or shareholder’s equity (SE)] AND which financial statement the account would appear in [Income Statement (I/S) or Balance Sheet (B/S)].

problem3) – TRANSACTION ANALYSIS

For each of the transactions listed below you are required to identify the effect on the relevant accounting elements (Assets, Equity or Liabilities) by indicating the amount and whether the element is being increased / decreased (+ / -). An ex has been provided in a suggested format below.

Transactions:

EG. Bought Inventory on credit from ABC Suppliers at a cost of R4 900.

4.1 The owner contributed R5000 cash into the business as a capital contribution.

4.2 A vehicle was bought and paid for in cash for R75 000.

4.3 Water and electricity for the period came to R570. This amount has not yet been settled.

ASSETS OWNERS EQUITY LIABILITIES

EG +4 900 0 +4 900