problem 1: If they devote all of their resources, Japan can produce 150 cars per year or 100 buses per year. Vietnam is able to produce 100 cars a year or 95 buses year. If the two countries were to trade, they would produce:

A) 150 cars and 100 cars

B) 100 buses and 95 buses

C) 150 cars and 95 buses

D) 100 buses and 100 cars

problem 2: Dan owns a donut shop and wants to increase his revenue. He knows that the elasticity for the demand of donuts in his town is -.80. What would be his best course of action to raise revenue?:

A) Keep prices the same, but make more donuts.

B) Increase his prices.

C) Decrease his prices

D) Keep prices the same, but make less donuts.

problem 3: The following group of goods would be considered nearly perfectly inelastic:

A) Medicine

B) Grains

C) Cars

D) Lumber

problem 4: A major clothing corporation attempted to alter their overall revenue by increasing prices on all of their pants by 5%. In response, they sold 200 pairs of pants instead of their normal 300. What is the elasticity of demand for their product?:

A) -6.67

B) 0.15

C) -1.15

D) 1.15

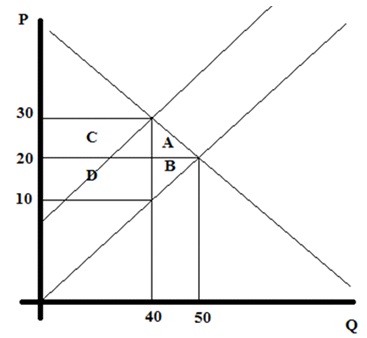

For problems 5-8, refer to the graph of a taxed good below:

problem 5: The amount of dead weight loss due to this tax is:

A) $50

B) $100

C) $300

D) $800

problem 6: The amount of revenue made from just the consumers is equal to:

A) $50

B)$200

C) $400

D) $450

problem 7: The region(s) of the graph that correspond to the loss of producer surplus is/are:

A) B

B) A

C) D and B

D) A and C

problem 8: The burden of the tax displayed above is placed on:

A) The producers

B) The consumers

C) Split equally between consumers and producers

D) There is not enough information

problem 9: The UK had a great economic year and produced an extra 500,000 tons of goods to export to the US. Doing so caused which following change to their currency:

A) It did not change.

B) It depreciated versus the US dollar.

C) It appreciated versus the US dollar.

D) It will change, but cannot determine direction.

problem 10: Russia is running an account deficit and currently imports much of their manufactured goods. The Russian government decides to institute a large tariff on imported manufactured good. What is the likely effect of the tariff:

A) The account deficit will increase.

B) More manufactured goods will be imported.

C) The economy will grow weaker

D) Russia will produce more manufactured goods.