problem)

(a) Discuss giving reasons which accounting conventions/concepts you regard as most important in helping preparers and auditors of financial statements to do their work.

(b) Discuss giving reasons which accounting conventions you regard as most useful from the viewpoint of the readers of financial statements.

problem)

describe in your own words, in a way that is understandable to a non-accountant, the following terms:

(a) Asset

(b) Liability

(c) Income

(d) Revenue

(e) Expense

(f) Equity

problem)

At least seven different groups of users of accounting information can be distinguished, i.e.:

i) Investors

ii) Lenders

iii) Employees

iv) Suppliers and other creditors

v) Customers

vi) Governments and their agencies

vii) Public

Required:

(a) Describe the information that each user mentioned above is likely to need from accounting statements and reports.

(b) In your view are there likely to be difficulties in satisfying the needs of all the groups mentioned above with one common set of information? describe.

problem)

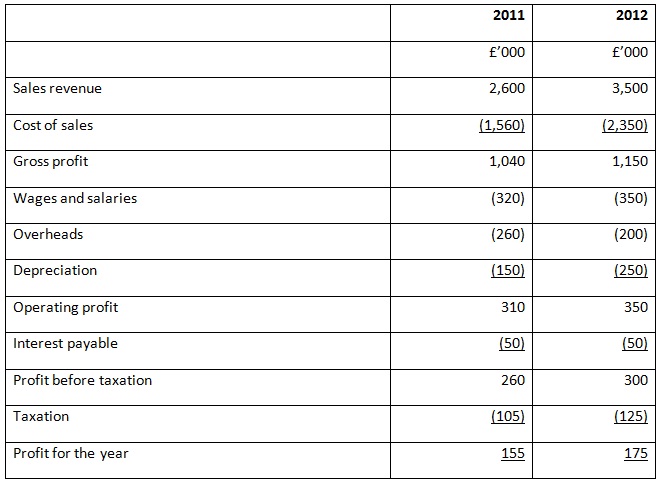

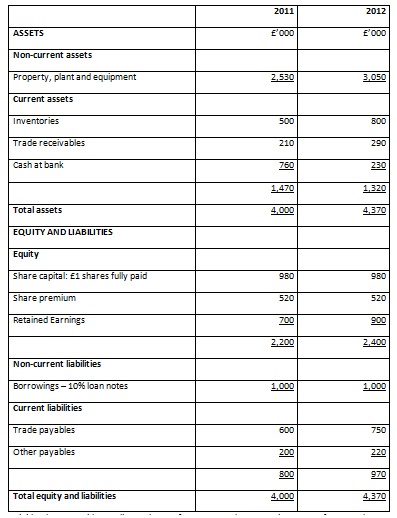

The financial statements of Harrow Ltd are given below for the two years ended 30 June 2011 and 2012. Harrow Limited operates a department store in the centre of a small town.

Harrow Ltd Income statement for the years ended 30 December

Harrow Ltd Statement of financial position as at 31 December

Required:-

(a) Choose and find out ten ratios that would be helpful in assessing the performance of Harrow Ltd. Use end-of-year values and find out ratios for both 2011 and 2012.

(b) Using the ratios find outd in (a) and any others you consider helpful, comment on the business’s performance from the viewpoint of a prospective purchaser of a majority of shares.

Learning Outcomes

• students to be able to describe the scope and uses of accounting;

• to understand the accounting conventions underpinning the income statement and balance sheet; and

• to develop and demonstrate skills in understanding and handling accounting data in order to interpret and analyse financial statements for the purposes of planning, decision making and control.