Problem 1:

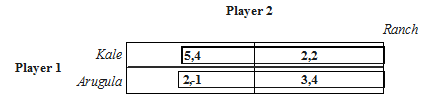

For the normal form game below, solve for all Nash equilibria and provide a justification for players' preferences over each of these equilibria. Show your work.

Problem 2: Treat the above normal form game as a stage game in infinitely repeated play. Assume both players have a common discount factor S E [0,1). For each of the scenarios listed below, indicate whether those actions can be sustained in each stage game as a part of a subgame perfect Nash equilibrium. Justify your answer and show your work. If a SPNE can exist, provide a complete description of an example. If no SPNE can exist, explain why. Note: "yes" or "no" answers without work will earn zero points.

(a) In each period, player 1 chooses Kale and player 2 chooses Ranch.

(b) In each period, player 1 chooses Kale and player 2 chooses Balsamic.

(c) In each period, player 1 chooses Arugula and player 2 chooses Ranch.

(d) In each period, player 1 chooses Arugula and player 2 chooses Balsamic.

(e) In each period, player 1 chooses Kale probabilistically with Prob(Kale) = 0.75 and player 2 chooses Ranch probabilistically with Prob(Ranch) = 0.25.

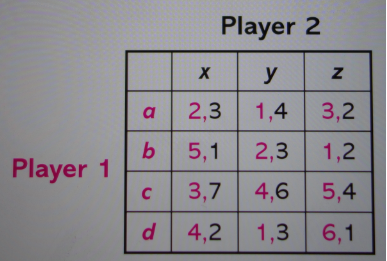

Problem 3:

For the game illustrated in FIGURE, find all mixed-strategy Nash equilibria.