1. Consider the following policies, each of which is aimed at reducing violent crime by reducing the use of guns. Illustrate the effect of each of these proposed policies in a demand and supply diagram of the gun market. For each question, show the price paid by consumers, the price received by producers, and the quantity of guns sold. What is the difference between the price paid by consumers and the price received by producers? Has the number of guns sold increased or decreased?

a. A tax on gun buyers

b. A tax on gun sellers

c. A binding price floor on guns

d. A tax on gun ammunition

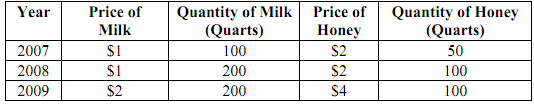

2. Below are some data from the land of milk and honey:

a. Compute nominal GDP, real GDP, and the GDP deflator for each year using 2009 as the base year.

b. Compute the growth in nominal GDP, real GDP, and the GDP deflator in 2008 and 2009. For each year, identify the variable that does no change. Explain your answers.

c. Did economic well-being rise more in 2008 or 2009? Explain.

3. Suppose you are given the following information:

Qs = 100 + 3P

Qd = 400 - 2P

where Qs is the quantity supplied, Qd is the quantity demanded and P is price.

a. From this information compute equilibrium price and quantity.

b. Now suppose that a tax is placed on buyers so that Qd = 400 - (2P + T) where T is taxes. If T = 15, solve for the new equilibrium price and quantity.

c. Compare your answers in (a) and (b). What does this show you?

4. Use the loanable funds model to explain what happens to interest rates and investment if a government moves from a balanced budget position to a budget surplus.

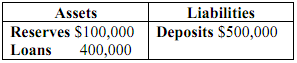

5. Suppose that the T-account for The Open Campus National Bank (OCNB) is as follows:

(a) If the central bank requires banks to hold 5% of deposits as reserves, how much in excess reserves does OCNB now hold?

(b) If OCNB decides to reduce its reserves to only the required amount, by how much would the economy's money supply change?

6. (a) Explain the adjustment process that creates a change in the price level when the money supply increases.

(b) Explain with the aid of a diagram what happens to the money supply, money demand, the value of money, and the price level if the central bank increases the money supply.

(c) Explain with the aid of a diagram what happens to the money supply, money demand, the value of money, and the price level if people demand less money at every price level.