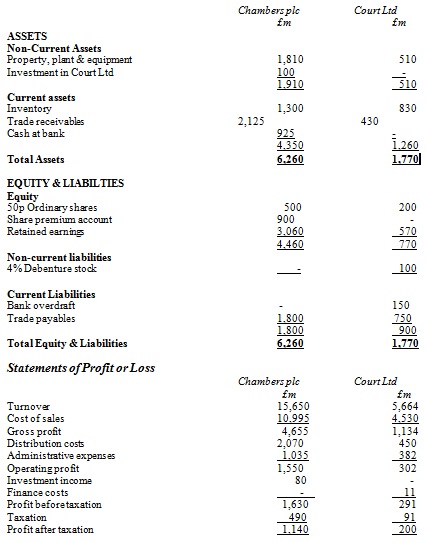

problem: Chambers plc imports household equipment from Germany. On 1 July 2011, the company acquired 60 percent of the ordinary shares of Court Ltd, which owns a chain of retail shops selling household equipment. Draft financial statements of the two companies at 30June 2012 have been prepared as shown below:

Statements of Financial Position:

Notes:

1) The purchase by Chambers plc of the shares in Court Ltd was financed through the payment of 25p (£0.25) cash per share and by the issue of 1 share in Chambers for every 2 shares in Court. Only the cash component has been accounted for in the draft Statement of Financial Position of Chambers. At the time of acquisition shares in Chambers were trading at 370p per share; shares in Court were at that time valued at 180p. The balance of Court’s retained earnings was £470 million on 30 June 2011. There have been no changes in the ordinary share capital of Court Ltd over the year. Chambers plc intends to use the fair value process to account for goodwill arising on acquisition.

2) When Chambers plc acquired its interest in Court; it valued that company's freehold property at £30 million above its book value. The freehold property had an average remaining useful life of 15 years at that time. Depreciation must be charged to distribution costs.

3) Throughout the year ended 30 June 2012 Court purchased goods from Chambers for £180 million. Of these, items which had cost Court £90 million are still involved in inventory at the year-end. Chambers has a margin on selling price of 30%.

4) Included in Chamber’s trade receivables is a balance due from Court of £60 million. Court’s trade payables include a balance of £20 million due to Chambers. On 30 June 2012 a bank transfer for £40 million had been sent by Court to Chambers. This was not received in Chambers bank account till 1st July.

5) Throughout the year Chambers plc paid a dividend of £340 million and Court Ltd paid a dividend of £100 million. The balance of Chambers retained earnings was £2,260 million at 30th June 2011.

problem: Non-current assets

Required:

describe, and critically analyze, the differences among the accounting treatment of self- constructed tangible non-current assets under IAS 16 Property, plant and equipment and internally generated intangible non-current assets under IAS 38 Intangible Assets.