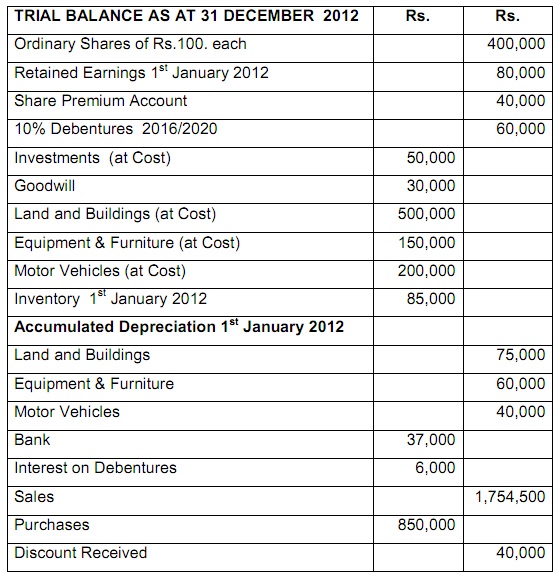

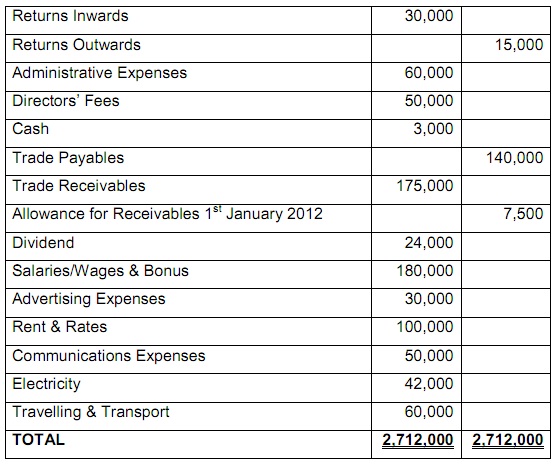

ELECTRONICS Plc is a Public Company engaged in retail business of Computer Gadgets and Car Audio Accessories. The given Trial Balance has been extracted from the books of business as at 31st December, 2012.

The given information was made aware to you as at 31st December 2012:

a) The Closing Inventory had cost Rs.105,000. These comprised goods costing Rs.16,000 however which had a Net Realisable Value of Rs.7,000;

b) The Advertising Expenses comprise an amount of Rs.8,000 representing the cost of a Billboard display to be appearing in February 2013;

c) The Electricity bill for the Month of December Rs.6,000 was settled in following month;

d) The Allowance for Receivables is to be adjusted to 5 percent of Trade Receivables and charged to ‘Administrative Expenses’;

e) The Investments have not been revalued. They are to be shown at cost;

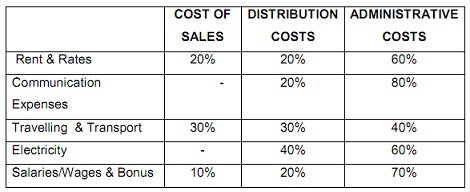

f) The given expenses are to be apportioned as pointed:

g) The Fixed Assets are to be depreciated at the rates illustrated below and be charged equally to Distribution Costs and Administrative Costs.

Land and Buildings - 5% per annum on cost

Equipment & Furniture - 20% per annum Straight Line Basis;

Motor Vehicles - 25% per annum Reducing Balance basis

h) The Goodwill was purchased on 1st January 2012 and it was decided to prepare it off over a period of 5-years. This is to be charged as an ‘Administrative Expense’; and

i) Tax for the year has been computed at Rs.62,000.

Required:

Make the given Financial Statements for ELECTRONICS Plc in accordance with “I.A.S 1” “Presentation of Financial Statements”

1) Statement of Comprehensive Income for the Year ending 31st December 2012.

2) Statement of Financial Position as at 31st December 2012.