Economics of Money and Banking Assignment -

Part A -

Question 1 - Consider an economy with a constant population N = 100. Individuals are endowed with y = 20 units of the consumption good when young and nothing when old.

a) What is the equation for the feasible set of this economy? Portray the feasible set on a graph.

b) Now look at a monetary equilibrium. Write down equations that represent the constraints on first- and second-period consumption for a typical individual. Combine these constraints into a lifetime budget constraint.

c) Suppose the initial old are endowed with a total of M = 400 units of fiat money. What condition represents the clearing of the money market in an arbitrary period t? Use this condition to find the real rate of return of fiat money.

For the remaining parts of this exercise, suppose preferences are such that individuals wish to hold real balances of money (vtmt) worth y/(1+(vt/vt+1)) goods (This demand for fiat money comes from the utility function (c1,t)½ + (c2,t+1)½).

d) What is the value of money in period t, vt? Use the assumption about preferences and your answer in part c to find an exact numerical value. What is the price of the consumption good pt.

e) If the rate of population growth increased, what would happen to the rate of return of fiat money, the real demand for fiat money, the value of a unit of fiat money in the initial period, and the utility of the initial old?

f) Suppose instead that the initial old were endowed with a total of 800 units of fiat money. How do your answers in part d change? Are the initial old better off with more units of fiat money?

Question 2 - In the textbook, we modeled growth in an economy by a growing population. We could also achieve a growing economy by having an endowment that increases over time. To see this, consider the following economy: let the number of young people born in each period be constant at N. There is a constant stock of fiat money, M. Each young person born in period t is endowed with yt units of the consumption good when young and nothing when old. The individual endowment grows over time so that yt = αyt-1 where α > 1. For simplicity, assume that in each period t, individuals desire to hold real money balances equal to one-half of their endowment (vtmt = ½yt).

a) Write down equations that represent the constraints on first- and second-period consumption for a typical individual. Combine these constraints into a lifetime budget constraint.

b) Write down the condition that represents the clearing of the money market in an arbitrary period t. Use this condition to find the real rate of return of money.

Part B -

Question 1 - In this question we derive mathematical representations of the demand of fiat money from specific utility functions. In the main body of the text, we have simply assumed certain demand-for-money functions to illustrate monetary equilibria. Chapter 2 section 10 looks at how the demand of fiat money can be obtained from the utility function. Looking at that Section helps you a lot to solve this question.

The problem facing a young person born at t is to maximize her lifetime utility, which is a function of consumption in each period of life. We can write the life time utility in the following form

U (c1,t, c2,t+1)

We assume that the function is continuous in each argument. Recall that the first and second period budget constraints are

c1,t + vtmt ≤ y (1)

c2,t+1 ≤ vt+1mt. (2)

let's solve for a young person's real demand for fiat money, vtmt, by following parts.

a) Derive the first order condition for the general functional form for the utility function.

b) Suppose the utility function is

U (c1,t, c2,t+1) = (c1,t)½ + (c2,t+1)½

Find the optimal demand for fiat money, q*t.

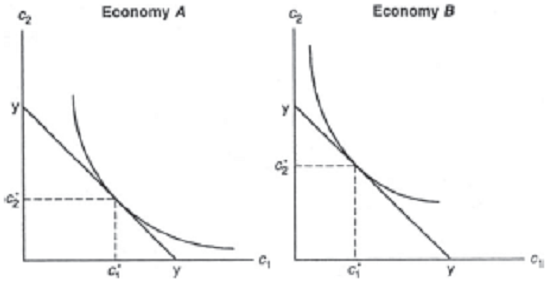

Question 2 - Consider two economies A and B. Both economies have the same population, supply of fiat money, and endowments. In each economy, the number of young people born in each period is constant at N, and the supply of fiat money is constant at M. Furthermore, each individual is endowed with y units of the consumption good when young and zero when old. The only difference between the economies is with regard to preferences. Other things being equal, individuals in economy A have preferences that lean toward first-period consumption; individual preferences in economy B lean toward second-period consumption. We will also assume stationarity. More specifically, the life-time budget constraints and typical indifference curves for individuals in the two economies are represented in the following diagram:

a) Will there be a difference in the rates of return of fiat money in the two economies? If so, which economy will have the higher rate of return of fiat money? Given an intuitive interpretation of your answer.

b) Will there be a difference in the value of money in the two economies? If so, which economy will have the higher value of money? Given an intuitive interpretation of your answer, supply of money and population), money will have a higher value in economy B than in economy A.