Economics Homework - Dagwood and Homer and the Savings Function

Instructions: Please show all work or points will be taken off.

Since the beginning of the year the S&P 500 index is up about 12% with a corresponding increase of about $ 2.2 trillion in stock market wealth. The most recent labor market report indicates that the economy is doing quite well. These and other economic indicators, along with hints from federal reserve officials, imply that the Fed is going to continue to raise interest rates. So in this problem, we reverse the news for Dagwood, relative to the problem we did in class. That is, Dagwood goes to the mailbox and gets happy news, his stock market wealth has increased and he is feeling very nice.

The fortunes of our friend Homer are opposite from the problem we did in class as well. Given that he works in the green energy field, the appointment of the new director of the EPA is not favorable for Homer's continued employment and thus, he must take a pay cut.

Q1. Suppose we have Dagwood, who has a current income of $200K and expected future income of $60K. He has $ 100K in current wealth (i.e., 'a' = $100K), but this is before he opens his 'retirement' (401K) envelope. He has zero expected future wealth (i.e., af = 0).

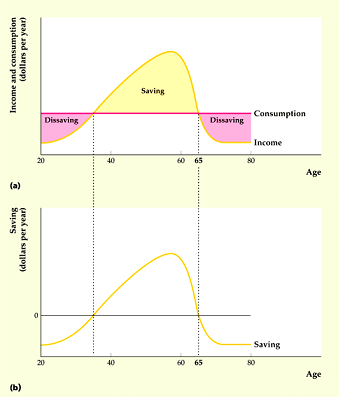

Dagwood's behavior is consistent with the life-cycle theory of consumption. For one, he perfectly smoothes consumption and two, since he is in his peak earning years, he is saving now so that he can maintain his current level of consumption in the future. Given that Dagwood faces a real interest rate of - 0.03, answer the following questions.

a) Calculate Dagwood's optimal consumption bundle showing all work. Then draw a completely labeled graph (the two period consumption model) depicting this initial optimal consumption bundle as point C*A (please use the space below). Note, for all C* calculations, round down to one decimal point.

(15 points for a completely labeled graph - be sure to label the no lending / no borrowing point = NL/NB and the slope of each budget constraint)

b) Now Dagwood opens up that envelope and happily finds that his current wealth rises from $100K to $140K. Recalculate Dagwood's 'new' optimal consumption point and label on your graph as point C*B. Is Dagwood worse off or better off? Explain (hint, what has happened to his budget constraint (aka opportunity set)).

c) In steps Janet Yellen and the Fed. Given that the economy appears to be on sound footing, the Fed raises interest rates so that the real rate of interest rises to 0.07. Recalculate the optimal bundle for Dagwood and add this point to your graph and label as point C*C. (Note, point C*C incorporates the shock to wealth in part b))

d) Is Dagwood better or worse off due to the rise in the real rate of interest? Explain being sure to discuss exactly how the substitution and income effects play a role here. Be sure to define what the income and substitution effects are and how they play a role in Dagwood's decision to alter his previously optimal bundle (we are comparing part b) to part c)). Also, comment on whether these income and substitution effects work in the same or opposite direction (i.e., is it a tug of war or do they work in the same direction?) in this particular case. Please include actual numbers when discussing the income and substitution effects or points will be taken off.

Q2. Dagwood's neighbor, Homer Simpson, does not abide by the life cycle theory of consumption. Homer has a "let's live life like it's our last day" mentality and thus, he prefers to consume more today, relative to the future. In particular, Homer prefers to consume exactly twice as much today (c), relative to consumption next period (cf). Homer's current income equals $250K and his future expected income = $250K. He has no wealth (neither current nor expected) since he lives like today is his last! Homer faces an initial real interest rate of -0.03, just like our friend Dagwood. Please answer the following questions.

a) Solve for Homer's optimal consumption basket today (C*) and his optimal consumption basket next period (Cf*). Please provide a completely labeled graph depicting these results and label this point as C*A.

(15 points for a completely labeled graph - be sure to label the no lending / no borrowing point = NL/NB and the slope of each budget constraint)

b) Homer goes to work and the rumor being spread around the work place is not good. Homer works in the 'green energy' field and given the new head of the EPA, green energy grants are being cut. Homer is forced to take a pay cut so that his current income (Y) falls to $150K. The boss assures Homer that this cut in his current income is temporary so that his future income (Yf) is unchanged and still equals $250K. Recalculate the optimal bundle for Homer and add this point to your graph and label as point C*B. Is Homer worse off or better off? Explain (hint, what has happened to his budget constraint (aka opportunity set)).

c) In steps Janet Yellen and the Fed. Given that the economy appears to be on sound footing, the Fed raises interest rates so that the real rate of interest rises to 0.07. Recalculate the optimal bundle for Homer and add this point to your graph and label as point C*C. (Note, point C*C incorporates the shock to Homer's current income in part b))

d) Is Homer better or worse off due to the RISE in the real rate of interest? Explain being sure to discuss exactly how the substitution and income effects play a role in Homer's consumption decisions. Also, comment on whether these income and substitution effects work in the same or opposite direction (i.e., is it a tug of war or do they work in the same direction?) in this particular case. Please include actual numbers when discussing the income and substitution effects or points will be taken off.

Q3) We are now going to graph savings functions for Dagwood and Homer and compare and contrast the slope and shifts of each. Savings in this problem is defined as: S = Y - C.......Y is current income and C is current consumption.

a) We are going to graph two savings functions for Dagwood. The first savings function to draw refers to the savings initially, before Dagwood opens up that envelope. Calculate the level of savings at the point CA* and label as point A on your diagram. Now you need to do some work. Calculate the level of savings if Dagwood did not receive a change in his current wealth (a remains at $100K) but Janet Yellen and the Fed raised interest rates to 0.07. Hint: you simply need to calculate what Dagwood's consumption would have been under these conditions and then calculate his savings.... label this as point B, connect points A and B and we have Dagwood's first savings function.

The second savings function is after the change in Dagwood's wealth. Label as point C, Dagwood's saving at point CB* and then label as point D, Dagwood's saving at point CC*. Connect points C and D and we have the second savings function for Dagwood. Be sure to label your diagram completely including all the shift variables that we are holding constant along any savings function with the signs ( + or - ) above the shift variables.

i) Did Dagwood's savings increase or decrease because of his change in current wealth - explain using the definition of savings: S = Y - C.

b) We are going to graph two savings functions for Homer. The first savings function to draw refers to the savings initially, before Homer gets the bad news at work. Calculate the level of savings at the point CA* and label as point A on your diagram. Now you need to do some work. Calculate the level of savings if Homer did not receive a change in his current income (Y remains at $250K) but Janet Yellen and the Fed raised interest rates to 0.07. Hint: you simply need to calculate what Homer's consumption would have been under these conditions and then calculate his savings.... label this as point B, connect points A and B and we have Homer's first savings function.

The second savings function is after the change in Homers current income. Label as point C, Homer's saving at point CB* and then label as point D, Homer's saving at point CC*. Connect points C and D and we have the second savings function for Homer. Be sure to label your diagram completely including all the shift variables that we are holding constant along any savings function with the signs ( + or - ) above the shift variables.

i) Did Homer's savings increase or decrease because of his change in current income - explain using the definition of savings: S = Y - C.