Economics for Managers (Macroeconomics) Exam

1) a) State as many engines of growth as you can think of.

b) Using the previous answer, describe the role of firms in the process of growth.

2) According to the article commented in class, Wages in Japan, Behind a pay wall, Raising Japanese wages is harder than it looks, published in The Economist on Sep 17th 2016, the International Monetary Fund recommends Japan to increase the wages.

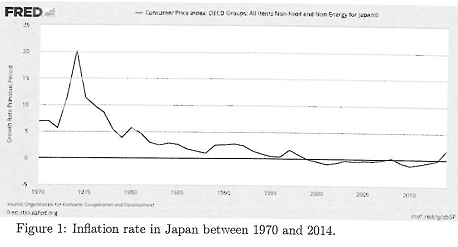

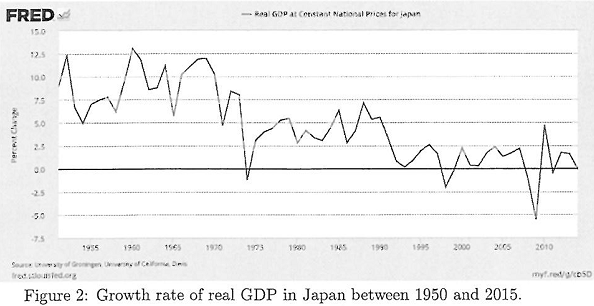

The background: we know that Japanese prices experiment stagnation or even decrease and that the growth rate of the economy slowed down a lot, see Figure 1 and 2.

a) Explain why deflation is bad.

b) Explain shortly how an increase in wages can improve performance of inflation.

c) Explain shortly how an increase in wages can improve performance of output. Describe the links between the mentioned variables.

3) The following text is the last paragraph of the article which appeared in The Economist, The global economy, The low-rate world, Central banks have been doing their best to pep up demand. Now they need help, on Sep 24th 2016.

"... Central banks have had to take on so much responsibility since the financial crisis because politicians have so far failed to shoulder theirs. But each new twist on ultra-loose monetary policy has less power and more drawbacks. When the next downturn comes, this kind of fiscal ammunition will be desperately needed. Only a small share of public spending needs to be affected for fiscal policy to be an effective recession-fighting weapon. Rather than blaming central bankers for the low-rate world, it is time for governments to help them.

a) State what is the purpose of such low interest rates (what a low interest rate is supposed to do to the economy?)

b) What if the central banks wanted to decrease their interest rates even more?

c) Why do they need help from a fiscal policy? Explain how can a fiscal policy stimulate the economy if the monetary policy is not used.

4) After the crisis governments in the developed countries started to perform expansionary fiscal policies, and once they found out that the budget deficit grew too much they started to do just the opposite There appeared works (scientific articles) saying that the application of this deficit fixing policies in the depressed economies will have very negative effects and will prolong the crisis. In the following exercise you are to show what was the point of the critics.

Consider economy where the autonomous consumption c0 = 20, marginal propensity to save c1 = 0.8, investment I = 50, government spending is G = 87, 5, the tax rate is 20%, τ = 0.2, exports are X = 43, 75 and the imports are dependent on output as IM = mY, where m is the marginal propensity to buy foreign goods and we will take m = 0.1.

a) Knowing that the consumption function is

C = c0 + c1(Y - T) c0 + c1 (1 - τ)Y,

the net exports are

NX = X - IM = X - mY

and the goods market is in equilibrium when the demand

C + I + G + NX

equals to the supply Y

Y = c0 + c1 (1 - τ) Y + I + G + X - mY,

calculate the equilibrium output

Y = (c0 + I + G + X)/(1 - c1(1 - τ)+m). (1)

b) Check the budget balance.

c) Increase government spending in 10. Calculate the equilibrium output and check the budget balance.

d) What is the value of the government multiplier? Note: We can define the government multiplier as

GOVmultiplier = ΔY/ΔG.

We read it as follows: if the government spending is changed in ΔG, the government multiplier will determine how much the output changes, ΔY. Setting the new value of government spending to G' and the new value of output to Y', ΔG = G' - G and ΔY = Y' - Y, the formula (1) implies

Y' - Y = (c0 + I + G' + X)/(1 - c1(1 - τ)+m) - (c0 + I + G' + X)/(1 - c1 (1- τ) + m),

Y' - Y = (1)/(1 - c1 (1 - τ) + m)(G' - G),

GOVmultiplier = ΔY/ΔG = (1)/(1 - c1(1 - τ) + m).

Now assume that the economy is below potential output and households feel insecure about the future and reduce the fraction of income they devote to foreign goods m' = 0.05.

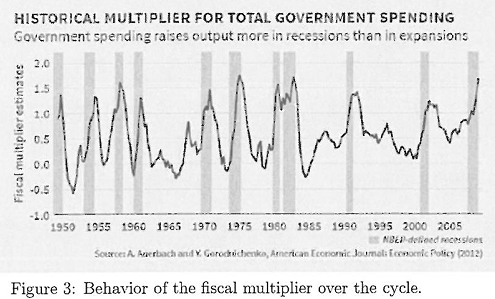

e) Calculate the multiplier in a recession. Confirm the findings that the multipliers are higher in recessions, as found by several research papers and shown in Figure 3.

f) What does that imply if the government follows an austerity policy in a recession? Explain. Argue.

5) Show on the following example what the comparative advantage means and illustrate the welfare improvement brought by specialization and trade.

Consider two islands that produce wheat and apples. In Carlos' island one worker can produce 400 bushels (about 36 liters) of wheat or 1000 apples. In the Greta's island one worker can produce 1000 bushels of wheat or 1250 apples, see Table 1 below.

|

|

Apple Island (Carlos)

|

Wheat Island (Greta)

|

|

Bushels of wheat produced by each family member in one year

|

400

|

1,000

|

|

Number of apples produced by each family member in one year

|

1,000

|

1,250

|

|

Relative price of wheat

|

1,000/400 = 2.5

|

1,250/1,000 = 1.25

|

|

Relative price of apples

|

400/1,000 = 0.4

|

1,000/1,250 = 0.8

|

Table 1: Production of the two goods by 1 worker in each island.

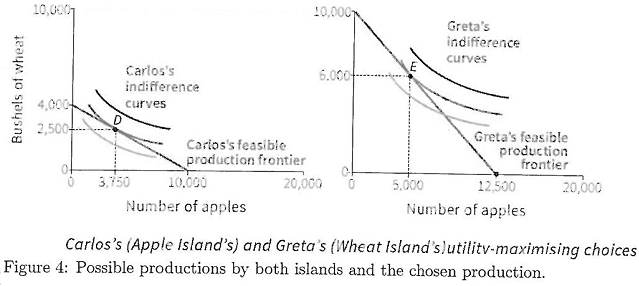

There are 10 people working on each island and their total production is illustrated in Figure 4: Carlos' island can produce 10000 apples or 4000 bushels of wheat, Greta's island can produce 12500 apples or 10000 bushels of wheat. The preferred consumption in the Carlos' island is 3700 apples and 2500 bushels of wheat. The preferred consumption in the Greta's island is 5000 apples and 6000 bushels of wheat.

a) Who has absolute advantage in the production of the two goods? Explain.

b) What is the total production (and consumption, you have to consider that it is produced what is liked by people) in both islands under autarky (=no trade)?

c) If both islands are to be involved in trade, who has the comparative advantage in which good production? Explain.

d) What is the total production in both islands under specialization?

e) Argue about the desirability of trade between the two islands.

Attachment:- Example.rar