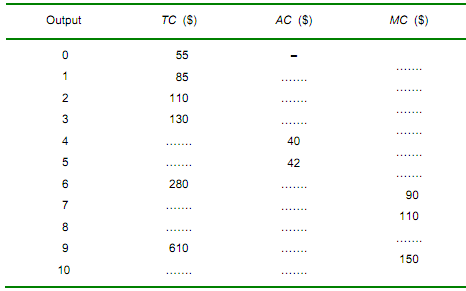

1. (a) Complete the following table of costs for a firm. (Note: enter the figures in the MC column between outputs of 0 and 1, 1 and 2, 2 and 3, etc.)

(b) How much is total fixed cost at:

(i) an output of 0? ...............................................................................................................

(ii) an output of 6? ...............................................................................................................

(c) How much is average fixed cost at:

(i) an output of 5? ...............................................................................................................

(ii) an output of 10? .............................................................................................................

(d) How much is total variable cost at an output of 5? ..................................................................

(e) How much is average variable cost at an output of 10? ..........................................................

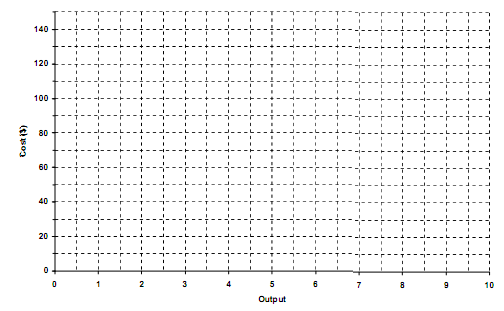

2. (a) Referring to the data from question 1, draw the firm's average and marginal cost curves on the following diagram. (Remember to plot MC mid-way between the quantity figures.)

(b) Mark on the diagram the output at which diminishing returns set in.

(c) Assume that the firm is a price taker and faces a market price of $60 per unit.

Draw the firm's AR and MR curves on the above diagram.

(d) How much will it produce in order to maximize profit? .........................................................

(e) Shade in the amount of profit it makes.

(f) Calculate how much profit this is. .........................................................................................

3. The following is a list of various types of economies of scale:

(i) The firm can benefit from the specialisation and division of labour.

(ii) It can overcome the problem of indivisibilities.

(iii) It can obtain inputs at a lower price.

(iv) Large containers/machines have a greater capacity relative to their surface area.

(v) The firm may be able to obtain finance at lower cost.

(vi) It becomes economical to sell by-products.

(vii) Production can take place in integrated plants.

(viii) Risks can be spread with a larger number of products or plants.

Match each of the following examples for a particular firm to one of these types of economy of scale.

(a) Delivery vans can carry full loads to single destinations. ...............

(b) It can more easily make a public issue of shares. ...............

(c) It can diversify into other markets. ...............

(d) Workers spend less time having to train for a wide variety of different tasks, and less time moving from task to task. ...............

(e) It negotiates bulk discount with a supplier of raw materials. ...............

(f) It uses large warehouses to store its raw materials and finished goods. ...............

(g) A clothing manufacturer does a deal to supply a soft toy manufacturer with offcuts for stuffing toys. ...............

(h) Conveyor belts transfer the product through several stages of the manufacturing process. ...............

4. If, at the current level of output, a firm's average cost is greater than its marginal cost, then:

A. An increase in output must raise its average cost still further above marginal cost.

B. A reduction in output would raise average cost.

C. The firm is producing beyond its minimum average cost level.

D. The marginal cost curve is downward sloping at the current level of output.

E. Average fixed cost must be constant.

5. A firm discovers that if it either increases or reduces output, its short-run average cost increases. It follows that:

A. The firm is maximising profit at its present output.

B. The firm is maximising its marginal cost at its present at its present output.

C. The firm is producing at the point where marginal cost equals average cost.

D. Diseconomies of scale are present.

E. Total costs are at a minimum.

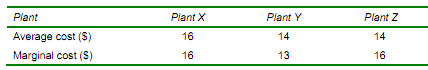

6. The information in the following table relates to a firm's average and marginal costs of operating each of three plants (X, Y and Z). Each plant has a U-shaped average cost curve.

The firm is a price taker, selling its product for $15 per unit. In order to maximize profit, the firm in the long run will:

A. Expand production at plant X, shut down plant Y and reduce production at plant Z.

B. Expand production at plant X, reduce production at plant Y and shut down plant Z.

C. Shut down plant X, expand production at plant Y and reduce production at plant Z

D. Shut down plant X, reduce production at plant Y and expand production at plant Z

E. Reduce production at plant X, expand production at plant Y and shut down plant Z.