1 A $550,000 capital investment proposal has an estimated life of four years and no residual value. The estimated net cash flows are as follows:

Year net cash flow

1 300000

2 280000

3 208000

4 180000

the minimum desired rate of return for net present value analysis is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636 respectively.

Determine the net present value.?

2. The net present value has been computed for Proposals P and Q. Relevant data are as follows:

proposal p proposal Q

Amount to be invested 265000 450000

Total present value of net cash flow 296500 425000

Determine the present value index for each proposal. Round your answers to two decimal places.

3. Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

Year net income net cash flow

1 $90000 $ 210000

2 80000 200000

3 40000 160000

4 30000 150000

total 240000 720000

The company's minimum desired rate of return for net present value analysis is 15%. The present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years is .870, .756, .658, and .572, respectively.

Determine (a) the average rate of return on investment, using straight line depreciation, and (b) the net present value.

|

a. The average rate of return on investment, using straight line depreciation

|

|

%

|

|

b. The net present value

|

$

|

|

4. Condelezza Co. manufactures two products, A and B, in two production departments, Assembly and Finishing. Condelezza Co. expects to produce 10,000 units of Product A and 20,000 units of Product B in the coming year. Budgeted factory overhead costs for the coming year are:

Assembly 310000

Finishing 240000

Total 550000

The machine hours expected to be used in the coming year are as follows:

Assembly finishing

Product a 15100 9000

Product b 4900 11000

Total 20000 20000

Round your answers to two decimal places, if necessary.

a. Compute the plantwide factory overhead rate.?$ per mh

Compute the production department factory overhead rates.

|

Assembly Dept.

|

$ per mh

|

|

Finishing Dept.

|

$ per mh

|

b. Compute the factory overhead per unit for each product using:

The single plantwide rate:

|

Product A

|

$ per unit

|

|

Product B

|

$ per unit

|

Production department factory overhead rates:

|

Product A

|

$ per unit

|

|

Product B

|

$ per unit

|

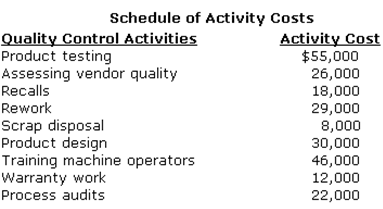

5. From the above schedule, calculate the following:

a. Value-added costs?$

b. Non-value-added costs?$

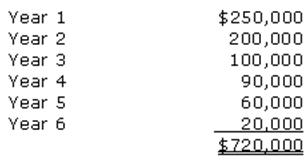

6,Proposals L and K each cost $500,000, have 6-year lives, and have expected total cash flows of $720,000. Proposal L is expected to provide equal annual net cash flows of $120,000, while the net cash flows for Proposal K are as follows:

Determine the cash payback period for each proposal. Round your answers to two decimal places, if necessary.

|

Proposal L:

|

years

|

|

Proposal K:

|

years

|