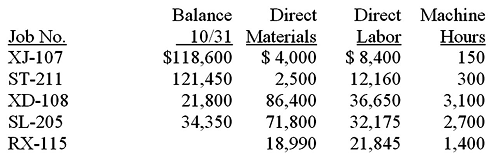

1. Maker Systems manufactures automated test systems that perform quality inspections during and at the completion of the manufacturing process. As most manufacturing processes are unique, Maker's test equipment is designed to customer specifications, and each system has a selling price in excess of $300,000. The company uses a job-order cost system based on the full absorption of actual costs and applies overhead on the basis of machine hours using a predetermined overhead rate. For the fiscal year ended November 30 budgeted manufacturing overhead was $1,960,000, and the expected activity level was 98,000 machine hours. Data regarding several jobs at Maker are presented below.

By the end of November all jobs but RX-115 were completed, and all completed jobs had been delivered to customers with the exception of SL-205.

Required:

(a) Determine the balance in the Finished Goods Inventory on November 30.

(b) Compute the cost of goods manufactured for November.

(c) Compute the Cost of Goods Sold for November.

(d) Determine the balance in Work-In-Process Inventory on November 30.

2. Prepare the necessary journal entries from the following information for Caudill Company.

a. Purchased materials on account, $56,700.

b. Requisitioned materials for production as follows: direct materials - 80 percent of purchases, indirect materials - 15 percent of purchases

c. Direct labor for production is $33,100, indirect labor is $12,500.

d. Overhead incurred (not including materials or overhead): $52,900.

e. Overhead is applied to production based on direct labor cost at the rate of 220 percent.

f. Goods costing $97,600 were completed during the period.

g. Goods costing $51,320 were sold on account for $77,600.

h. Close the overhead control account to Cost of Goods Sold.

3.Russell Corporation applies overhead based upon machine-hours. Budgeted factory overhead was $375,000 and budgeted machine-hours were 12,500. Actual factory overhead was $387,920 and actual machine-hours were 13,150.

Required:

a. Compute the overhead application rate.

b. Compute the amount of overhead applied to production.

c. Determine the amount of Over- or underapplied overhead.

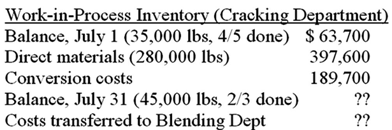

4. Walter manufactures a silicone paste wax that goes through three processing departments: cracking, blending, and packing. All raw materials are introduced at the start of work in the cracking department, with conversion costs being incurred uniformly in each department. The Work-in-Process T-account for the cracking department for July is:

The beginning balance inventory consists of $43,400 in materials cost. Brady uses the weighted-average method to account for its operations.

Required (use 4 decimal places for computations):

(a) What would be the Cracking Department inventory balance on July 31?

(b) What would be the cost transferred to the Blending Dept. in July?

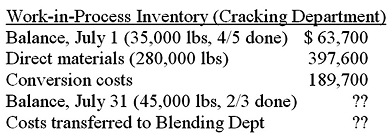

5. Walter manufactures a silicone paste wax that goes through three processing departments: cracking, blending, and packing. All raw materials are introduced at the start of work in the cracking department, with conversion costs being incurred uniformly in each department. The Work-in-Process T-account for the cracking department for July is:

The beginning balance inventory consists of $43,400 in materials cost. Brady uses the first-in, first-out (FIFO) method to account for its operations.

Required: (use 4 decimal places for computations):

(a) What would be the Cracking Department inventory balance on July 31?

(b) What would be the cost transferred to the Blending Dept. in July?

6. Fosson Furniture uses a process cost system to account for its chair factory. Beginning inventory consisted of 5,000 units (100% complete as to material, 55% complete as to labor) with a cost of $124,800 materials and $104,500 conversion. 58,000 units were started into production during the month with material costs of $1,537,000 and $2,124,375 of conversion costs. The ending inventory of 6,000 chairs was 100% complete as to materials and 40% complete as to labor. Fosson uses weighted-average costing.

Required: (HINT: use 4 decimal places in your calculations)

a. Compute the equivalent units of production for each input.

b. Compute the cost per unit.

c. Compute the cost transferred out to finished goods.

d. Compute the ending work-in-process inventory balance.

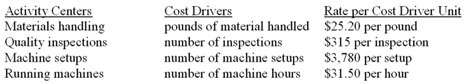

7. Get Real Inc., recently switched to activity-based costing from the department allocation method. The Fabrication Department manager has estimated the following cost drivers and rates:

Direct materials of $420,000 were put into production during July, and direct labor costs were $210,000. The Fabrication Department handled 5,250 pounds of materials, made 1,050 inspections, had 56 setups, and ran the machines for 21,000 hours during the month.

Required:

Prepare a schedule of the costs applied to work-in-process for July:

8.

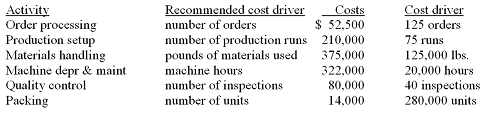

Jones Company manufactures and distributes three types of golf clubs: beginners, intermediate, and advanced. The materials used in these clubs increases in each level and allows for more precise balancing and longer wear. Production is highly automated for the beginners' clubs, whereas the intermediate and advanced clubs require a varying degree of labor, depending on the intricacy of the balancing process. Jones applies all indirect costs according to a predetermined rate based on direct labor hours. A consultant recently suggested that Jones switch to an activity-based costing (ABC) system, and identified the following cost breakdown for the upcoming year:

In addition, management estimates 50,000 direct labor hours will be used in the upcoming year at a rate of $14 per hour.

Assume that the following activity took place in the first month of the upcoming year:

Required:

a. Compute the production costs for each product in the first month of the upcoming year using direct labor hours as the allocation base.

b. Compute the production costs for each product in the first month of the upcoming year using machine hours as the allocation base.

c. Compute the production costs for each product in the first month of the upcoming year using activity-based costing.

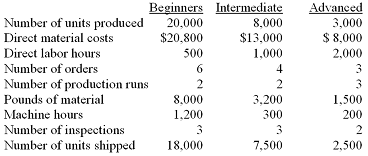

9. Categorize each of the following quality activities by placing an X in the appropriate column.

Required:

10.

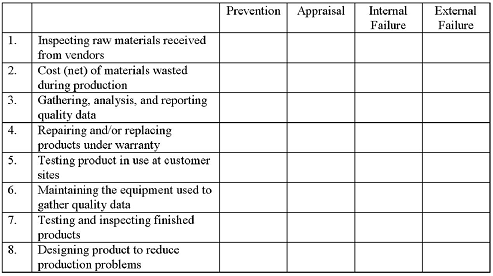

Ashland Food delivers supplies to small grocers throughout the region. Ashland Food currently adds 5% to the order cost to cover the delivery cost. The delivery fee is meant to just cover the cost of delivery. A consultant has analyzed the delivery service using activity-based costing methods and identified four activities. Data on these activities are:

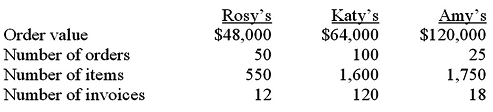

Three of Ashland Food's customers are Rosy's Corner Market, Katy's Fine Foods, and Amy's City Market. Below are data on orders and deliveries to these three customers:

Required:

(a) What would be the delivery charge for each customer under the current policy of 5% of order value?

(b) What would the activity-based costing system estimate as the cost of delivering to each customer?