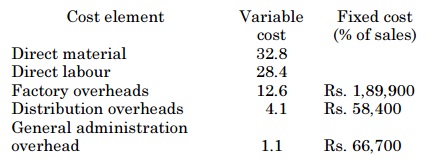

problem 1: An analysis of the Sultan Manufacturing Co. Ltd. led to the given information:

Budgeted sales are Rs. 18,50,000. You are needed to find out:

a) Break-even sales volume.

b) Profit at the budgeted sales volume.

c) Profit if actual sales:

• Drop by 10%

• Rise by 5% from budgeted sales.

problem 2: General manufacturers had a debit of balance of Rs. 8,00,000 in their machinery account on 1.1.1992. The concern was charging depreciation at 15% p.a. on diminishing balance. On 31.3.1992, a part of the machinery purchased on 1.1.1989 at a cost of Rs. 70,000 was sold for Rs. 45,000. New machinery was purchased for Rs. 80,000 on 1.7.1992 and Rs. 6,700 was spent for installation. On 31.12.1992 the concern decided to change the depreciation method from diminishing balance method to straight-line method. This was as well decided to charge depreciation at 10% p.a. under the new method. Make machinery account for the year 1992.

problem 3: Describe the accounting standards followed in India.

problem 4: describe various kinds of books maintained in the hospitals.

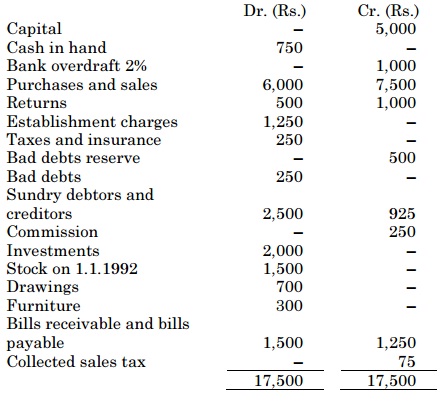

problem 5: From the given Trial Balance make Trading and Profit and Loss Account and Balance Sheet as on 31.12.1992 :

Adjustments:

a) Salary Rs. 50 and taxes 200 are outstanding but insurance Rs. 25 prepaid.

b) Commission amounting to Rs. 50 has been received in advance for work to be done next year.

c) Interest accrued on investments Rs. 105.

d) Bad debts reserve is to be maintained at Rs. 500.

e) Depreciation on furniture is to be charged at 10%.

f) Stock on 31st December, 1992 was valued at Rs. 2,250.

g) A fire occurred on 25th December, 1992, in the godown and stock of the value of Rs. 500 was destroyed. It was completely insured and insurance company admitted the claim in complete.