Objectives:

1) Demonstrate an ability to provide eliminating as well as adjusting entries in the preparation of consolidated worksheets.

2) Understand the difference between pre-control and post-control transactions.

3) Evaluate the importance of AASB 127 "Consolidated and Separate Financial Statements" and AASB 101 "Presentation of Financial Statements".

Part A

Investing in Related Entities

Compare the accounting treatment of dividends appropriated from pre-control and post control equities of a subsidiary. Consider the accounting by the companies paying and receiving the dividend, as well as by the corporate group.

Part B

Intra-group Transactions

In response to a question in an exam, a student stated: "Under AASB 101 there is a general prohibition against the offsetting of revenues and expenses and of assets and liabilities, yet under AASB 127 we offset assets and liabilities and revenues and expenses when eliminating the impact of intra-group transactions. How can the treatment required by AASB 127 be right?" Explain why the treatment in AASB 127 is consistent with the treatment required by AASB 101.

Part C

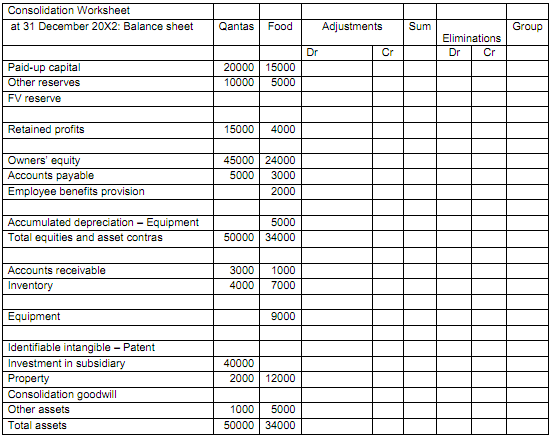

Acquisition Method - Introduction & Substitution

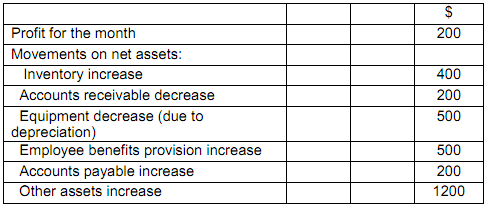

As part of the diversification program, the Board of Directors of Budget Airlines Ltd decided to buy all the shares of Food Ltd, a catering business, located in Australia. The purchase took place on 31 December 20x2, and the price of $40,000 is based on the fair value of Food's assets at that date. The fair values differ from Food's carrying amounts shown in the worksheet for two reasons. First, Food's most recent financial statements are dated 30 November. Food's estimated results for the month of December are:

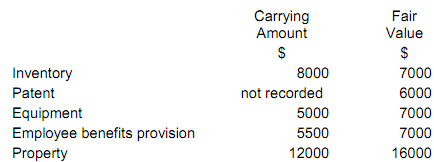

Second, the following items are not at fair value in Food's financial statements. Carrying amounts shown include adjustments made for Food's estimated results for December:

a) Food Ltd has not yet adjusted its financial statements to include missing transactions.

b) Food Ltd will be prevented by accounting standards from recognising an intangible asset.

c) Food Ltd applies the cost model to its equipment asset and a switch to the revaluation model is not appropriate in its circumstances. The Budget Airlines group usually applies the revaluation model under AASB 116, but other group members do not have any equipment of the type used by Food.

d) The employee benefits provision is based on the estimate of Bendzulla Actuarial Pty Ltd which will be taken up as an adjustment.

e) Food applies the revaluation model to property, but as at the control date it had not made a recent appraisal of the property's fair value.