Healthcare Costs

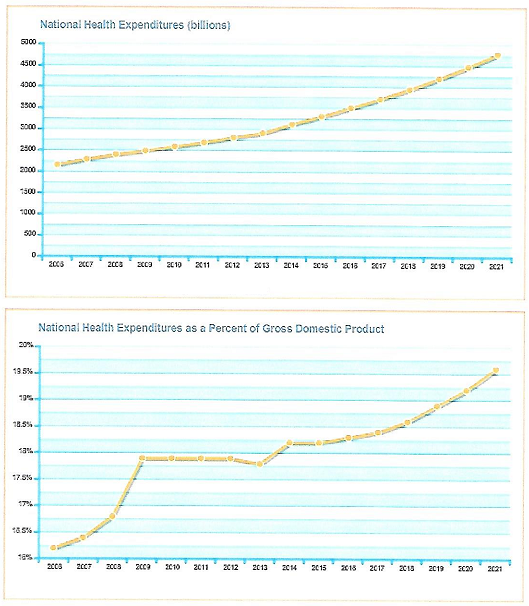

Growth in national health spending closely tracked growth in nominal gross domestic product (GDP) in 2010 and 2011, and health spending as a share of GDP remained stable from 2009 through 2011, at 17.9 percent (Micah et al., 2011).

Based on the above information, answer the following questions:

- Define the economic principle of opportunity cost.

- Locate current GDP expenditures and express the percentages in a graph or a chart.

- Explain whether spending 17.9% of GDP is too much or too little to spend on healthcare.

- Defend your position using the concept of opportunity cost and highlight specific GDP expenditures that are impacted by healthcare expenditure (opportunity cost).

Supply and Demand in Healthcare Industry

The graph below shows how national health expenditure (NHE) has been increasing over the years. In 2011, total spending on medical care in the United States was $21 trillion. Growth rate in healthcare expenditure stayed at 3.9 percent observed in 2010. According to the center for Medicare and Medicaid, health spending is projected to continue to grow modestly at 4.2 percent in 2012 and 3.8 percent in 2013.