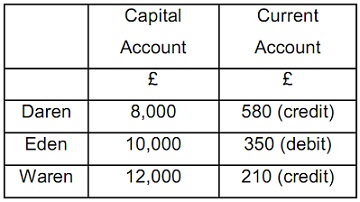

Daren, Eden and Waren are in partnership sharing profit and losses in the ratio of 5:2:3 correspondingly. At 1 November 2011 their capital and current account balances were:

This is the partnership agreement that:

1) Partners are entitled to interest on capital at the rate of 5% per annum.

2) Partners are permitted to withdraw from current accounts at any time throughout the financial year however charged interest on the amounts is involved.

3) Eden is remunerated by an annual salary of £ 2,500.

On 1 May 2012, by mutual agreement, Daren raised her capital by paying a further £ 2,000 into the partnership bank account, whilst Eden reduced her capital to £ 6,000 however left her withdrawn capital in the partnership as a loan bearing interest at 5% per annum.

The trading profit, before interest, for the year ended 31 October 2012 was £ 19,905.

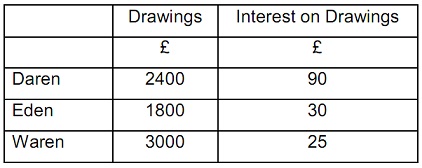

Details of drawings made and interest chargeable in respect of each partner for the financial year ended 31 October 2012 are:

Required: For the year ended 31 October 2012, make

a) The profit and loss appropriation account for the partnership.

b) The capital and current accounts of individual partners.

c) Describe the meaning of goodwill and when it is significant to consider goodwill in partnership.