Create Tables using SQL DDL

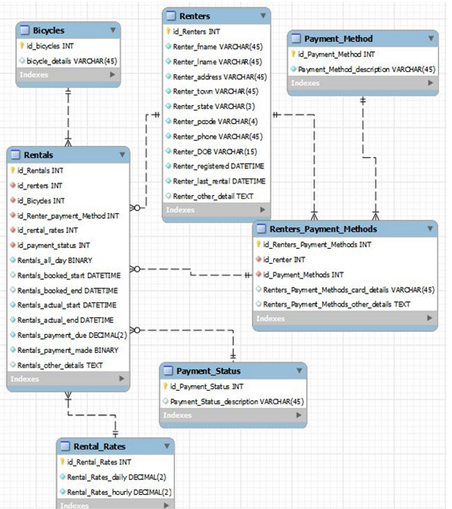

The following questions are based on the Bicycle Rental ERD as shown below:

Tasks:

- Write the SQL DDL to create the database that contains each of the relations shown in the above ERD. You will need to provide:

- Your DDL code for each table that you create; (20 marks)

- A screenshot showing each table that is created. (10 marks)

- Write and execute SQL definition commands for each of the following queries:

- Add the attributes Email, Comments and Send Newsletter to the Renters table. Give those attributes an appropriate size and data type (3 marks).

- Change the attribute Renters.renterDOB from type Varchar(15) to type DATE. (2 marks)

- Write and execute SQL commands for the following:

- Add the following customers to the Renters table. (3 marks)

- Write a command that will remove the Jones that lives in Orange from the Renters table (2 marks)

|

id_r

|

r_lname

|

rent_fname

|

r_address

|

r_town

|

r_state

|

r_pcode

|

r_phone

|

r_dob

|

|

12345

|

Jones

|

George

|

123 Bentinck St

|

Bathurst

|

NSW

|

2795

|

0212345678

|

01/05/1964

|

|

23456

|

Jones

|

Pauline

|

48 Summer St

|

Orange

|

NSW

|

2800

|

0223456789

|

11/09/1986

|

|

28765

|

Wilson

|

Paul

|

23 Long St

|

Blayney

|

NSW

|

2799

|

0298745621

|

22/12/1977

|

You are required to submit:

- The appropriate SQL command which should be copied from your source code in MySQL and pasted into your submission file; and

- The resultant tables, which must be screenshots to show the change due to the execution of the SQL commands.

Typing or manually drawing the results will NOT be accepted.