Corporate Tax Return Problem

Required:

- Complete Alvin's- Music Inc's (AMI) 2016 Form 1120, Schedule D, and Schedule G (if applicable) using the information provided below.

- Neither Form 4562 for depreciation nor Form 4797 for the sale of the equipment is required. Include the amount of tax depreciation and the tax gain on the equipment sale given in the problem (or determined from information given in the problem) on the appropriate fines on the first page of Form 112a Page C-14

- Assume that AMI does not owe any alternative minimum tax.

- If any information is missing, use reasonable assumptions to fill in the gaps.

- The forms, schedules, and instructions can be found at the IRS website, The instructions can be helpful in completing the forms.

Facts:

Alvin's Music Inc. (AMI) wasformed in 2007 by Alvin Jones and Theona Smith. Alvin and Theona officially incorporated their store on June 12, 2008. AMI sells (retail) all kinds of music-related products including musical instruments, sheet MELSiC, CDs, and DVDs. Alvin owns 60 percent of the outstanding common .stock of AMI and Theona owns the remaining 40 percent.

- AMI is located at 355 Music Way, East Palo Alto, California 94303.

- AMI's Employer Identification Number is 29-5748859.

- AMI's business activity is retail sales of music-related products. Its business activity code is 451140.

- Officers of the corporation are as follows:

- Alvin is the chief executive officer and _president (Social Security number 123-45-6789).

- Theona is the executive -vice president (Social Security number 978-65-4324

- Gwen Gairenz is the vice president over operations (Social Security number 789-12-3456).

- Carlson Bannister is the secretary (Social Security number 321-54-6789,k

- All officers devote 100 percent of their tiftte to the business and all cfficers are US. citizens.

- Neither Gwen nor Carlson owns any stock in AML

- AMI uses the accrual method of accounting and has a calendar year-end

- AMI made four equal estimated tax payments of $70,000 each Its tax liability last year was $175,000 If it has overpaid its federal tax liability, AMI would like to receive a refund.

- AMI paid a dividend of $80,000 to its shareholders on December 1. AMI had ample earnings and profits (E&P) to absorb the distribution

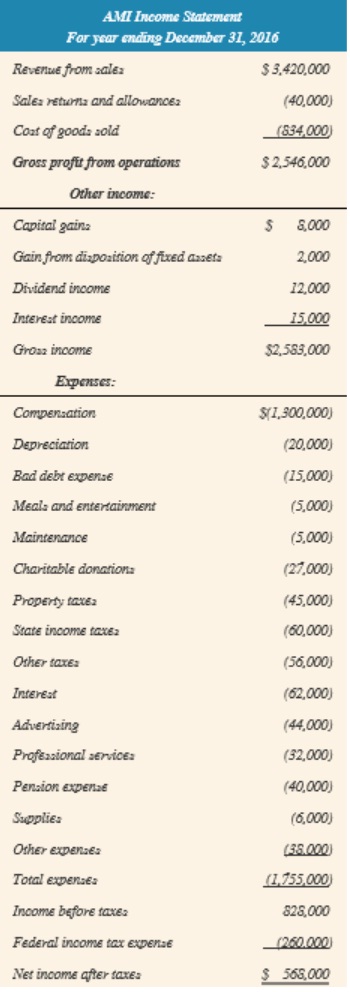

The following is AMI's audited income statement for 2016:

Notes:

1. AMI has a capital loss carryover to this year from last year in the amount of $5,000.

2. AMI's inventory-related purchases during the year were $1,134,000. AMI values its inventory based on coet using the FIFO inventory cost flow method. Assume the rules of §263A do not apply to AML

3. Of the $15,000 interest income, $2,500 was from a City of Fremont bond that was used to fund public activities (issued in 2015), $3.500 was from a Pleasanton city bond used to fund private activities. (issued in 2016), $3.000 was from a US. Treasury bond, and the remaining $6,000 was from a money market account.

4. AMI sold equipment for $10,1960. It originally purchased the equipment for $12,000 and, through the date of the sale, had recorded a cumulative total of $4,000 of book depreciation on the asset and a cumulative total of $6,000 of tax depreciation_ For tax purposes, the entire gain was recaptured as ordinary income under §1245.

5. AMI's dividend income came from Simon's Sheet Music. AMI owned 15,000 shares of the stock in Simon's Sheet Music (OM) at the beginning of the year This represented 15 percent of the SSM outstanding stock

6. On july 22, 2016 AMI sold 2,500 shares of its Simon's Sheet Music Stock for $33,000. It had originally purchased these shares on April 24, 2012, for $25,000. After the sale, AMI owned 12.5 percent of Simon's Sheet Music

7. compensation is as follows:

• Alvin $210000

• Theorra $190,000

• Gwen $110,000

• Carlson $90,000

• Other $700,000

8. AM1 wrote off $10,000 in accounts receivable as uncollectible during the year.

9. Regular tax depreciation was $31,000. None of the depreciation should be claimed on Form 1125A.

10. Of the $62,000 of interest expense, $56, 000 was from the mortgage on .4 MI's building and the remaining $6,000 of interest is from business-related loans.

11. The pension expense is the same for both book and tax purposes

12. Other expenses include $3,000 for premiums paid on term life insurance policies for which AMI is the beneficiary. The policies cover the lives of Alvin and Theona.

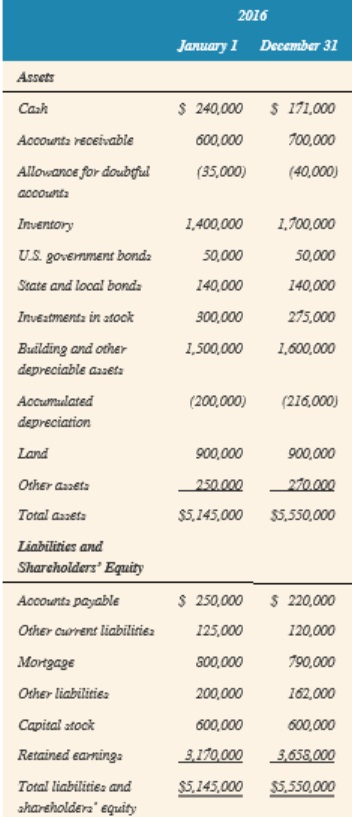

The following is AMI's audited balance sheets as of January 1, 2016 and December 31, 2016.