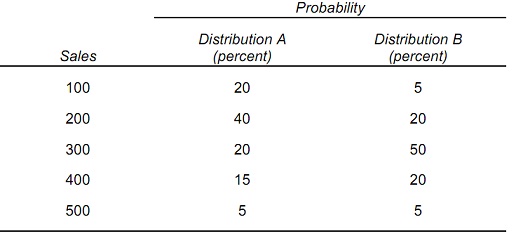

problem 1: Consider the given two probability distributions for sales:

a) Compute the expected sales for both of these probability distributions.

E(SalesA) = __________

E(SalesB) = __________

b) Compute the variance and standard deviation for both of the probability distributions.

σA2 = __________ and σ A = __________

σB2 = __________ and σ B = __________

Distribution _____ is more risky than distribution _______.

c) Compute the coefficient of variation for both distributions:

vA = __________

vB = __________

Distribution _____ has greater risk relative to its mean than distribution _____.

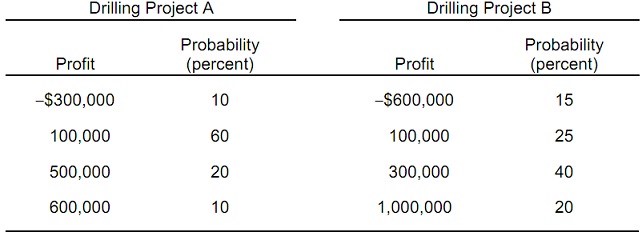

problem 2: Texas Petroleum Company is a producer of crude oil which is considering two drilling projects with the given profit outcomes and associated probabilities:

a) Evaluate the expected profit for both drilling projects.

E(ProfitA) = __________ and E(ProfitB) = __________

b) Based on the expected value rule, Texas Petroleum should choose drilling project _______.

c) find out the standard deviations of both projects:

σ A = __________ and σ B = __________

d) Which drilling project has the greater (absolute) risk?

e) Use mean-variance rules, if possible, to decide which drilling project to undertake. Describe.

f) find out the coefficient of variation for both projects:

vA = __________ and vB = __________

By using the coefficient of variation rule, Texas Petroleum should choose project _____.

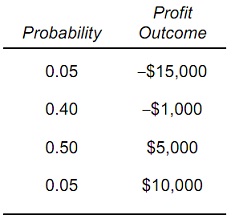

problem 3: A manager’s utility function for profit is U(π ) = 35π, where π is the dollar amount of profit. The manager is considering a risky decision with the four possible profit outcomes shown below. The manager makes the given subjective assessments regarding the probability of each and every profit outcome:

a) The expected profit is _______________.

b) The expected utility of profit is _____________.

c) The marginal utility of an extra dollar of profit is ________.

d) The manager is risk ___________ as the marginal utility of profit is ____________.

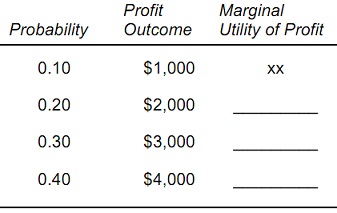

problem 4: Assume that the manager of a firm has a utility function for profit U(π ) = 12ln(π ), where π is the dollar amount of profit. The manager is considering a risky project with the following profit payoffs and probabilities:

a) The expected profit is _______________.

b) The expected utility of profit is _____________.

c) Fill in the blanks in the following table showing the marginal utility of an additional $1,000 of profit.

d) The manager is risk _________ because the marginal utility of profit is __________.

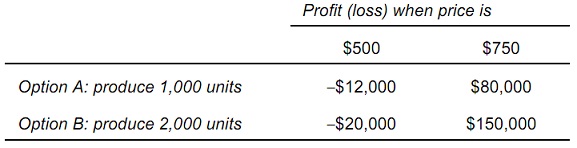

problem 5: A firm is making production plans for next quarter, but the manager doesn't know what the price of the product will be next month. She believes there is a 30 % chance that price will be $500 and a 70 percent chance that price will be $750. The four possible profit outcomes are:

a) Option ______ maximizes expected profit.

b) Option ______ is the riskier of the two options.

c) The manager _____________ (can, cannot) apply mean-variance rules in this decision. If the manager can use mean-variance rules, the manager would choose Option ______.

d) Using the coefficient of variation rule, the manager chooses Option _____.

problem 6: Suppose the manager in Problem 5 has absolutely no idea about the probabilities of the two prices occurring. Which option would the manager choose under each of the following rules?

a) Maximax rule _________________

b) Maximin rule _________________

c) Minimax regret rule _________________

d) Equal probability rule _________________