CASE STUDY: LYNDEN LIMITED

Research question consists of a case study: You are a graduate accountant working for White and Associates a public accounting firm.

The address the firm is 888 North Terrace, Adelaide SA 5000. The manager of your firm, Craig Happy has asked you to draft a letter in response to an email received from a client - Tim Jones, the managing director of Lynden Ltd, raising a number of issues regarding his company.

To: Craig Happy ([email protected])

From: Tim Jones ([email protected])

Re: Accounting Issues: Year Ending 30 June 2014

Sent: Wednesday, 12th February 2014

___________________________________________________________________________

Dear Craig

We currently have two accounting issues. Could you please provide us with some accounting advice for each issue. Please reference any relevant Australian Accounting Standards (AASB) in your letter, so we can show our external auditors at year end.

1. We currently have 20 staff who have been employed by Lynden Limited, for more than 10 years. Our HR department has accurately calculated the long service leave owing to these employees as $100,000, in respect of past services. We have no idea when these staff will take their long service leave, so we don't believe we need to show this as a liability in the financial statements. Mike, our director has suggested we should still disclose it as a contingent liability. Do you agree? If not, how should this be recorded and disclosed?

2. Mike, our director has suggested that we no longer need to show our non-current assets at their cost value in the balance sheet. Is this correct? Could you please outline our options? Would you advise us to show all our assets at market value or just increase those assets that have appreciated in the market?

Regards

T Jones

Tim Jones

Managing Director, Lynden Ltd

Level 5, 300 Greenhill Road

Adelaide SA 5000

Question 2

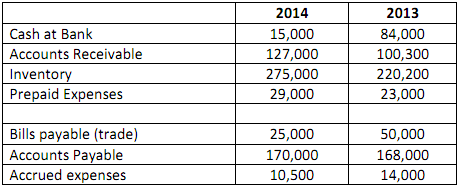

An extract of the comparative Balance sheet for Mortimer Limited on 30 June 2013 and 2014 is presented below:

Mortimer Limited Balance Sheet as at 30 June

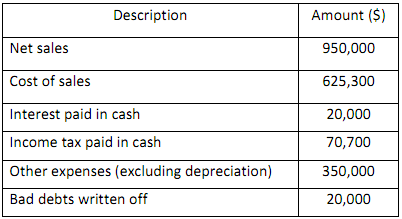

Other financial information as at 30th June 2014:

Required:

1. Using the direct method, prepare the Cash flows from Operating Activities.

Question 3 - Accounting for Income Tax

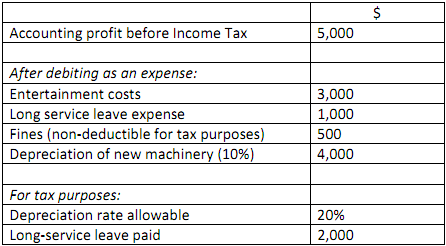

The following information relates to Gable Ltd:

Required:

Calculate taxable income and prepare the journal entry for current tax payable (the tax rate is 30%) as at 30th June 2014.